We are opening an insurance company. Car insurance. How to start an insurance business Insurance company example

To open it yourself insurance company starting from scratch will require significant investments, the payback of which will take at least four years. To work successfully in this area, the company must include in its range the maximum range of services that are directly or indirectly related to the main activity. This includes protection from risks to people and property, and expert work on the assessment of insured events.

[Hide]

Services

The range of services provided by the insurance agency, aimed at legal entities:

| Object of insurance | Description |

| Property | This service allows you to reduce the risk of unexpected expenses/losses in the event of damage/destruction/theft of insured property |

| Carrier liability | Entrepreneurs whose business is related to transportation various cargoes, can protect their commercial transport and/or transportation object |

| Responsibility of construction organizations | In December 2012, Federal Law No. 294 was adopted, obliging developers to insure their civil liability to shareholders. Thus construction companies protect their obligations to transfer the residential premises to the participant in shared construction within the period specified in the contract. Enterprises also protect themselves from the possibility of technical risks. This type insurance is the key to the financial security of a company carrying out construction and installation work. This protects the developer from numerous risks for objects under construction, property and special equipment at the construction site. |

| Financial risks | A businessman can protect his business from such dangers as:

|

| Staff | This insurance allows the employer to reduce costs in the event of work-related injuries and illnesses of employees. |

The range of basic insurance agency services aimed at individuals:

| Object of insurance | Description |

| Property | The client can insure:

Thus, the buyer of an insurance product protects his property from the following risks:

|

| Life/health | This service allows you to provide the relatives and friends of the insured citizen (in the event of a serious illness or death of the latter) with certain funds |

| Automobile | It is proposed to sell two types of policies:

The second type of service is the most profitable for the agency. The owner of the car will receive compensation in the event of an insured event, for example:

|

| Mortgage | This product will help the agency client fulfill his debt obligations to credit institution, for example, in case of loss of usual income due to:

|

| Health care | Voluntary health insurance allows you to receive:

|

Relevance

Circumstances causing attractiveness insurance business:

- high profitability;

- prospects;

- significant demand for insurance services;

- variety of activities and business formats;

- government support for the industry;

- moderate competition.

Market description and analysis

Main trends in the Russian insurance market:

- IN last years are in high demand the following types insurance: life, accident, property, financial risks.

- At the end of 2016, the total authorized capital of domestic insurers amounted to 216.5 billion rubles, and a year earlier it was 189.2. There is a trend towards consolidation of market participants both in terms of the size of the joint-stock fund and the amount of premiums. In 2016, the average capitalization of companies increased from 566 to 842 million rubles.

- As of December 2016, there were 251 insurance companies and 5 specialized reinsurance companies operating in Russia. At the end of 2017 there were total did not exceed 200 (including medical ones).

- Market leaders: PJSC Rosgosstrakh, JSC SOGAZ, PJSC Ingosstrakh.

- The upward trend in the concentration indicator remained in relation to companies above the TOP 10. An increase in this parameter is observed for all types, with the exception of business risk insurance.

- More than 70% of market participants have share capital up to 479 million rubles.

- In the structure of bonuses domestic companies Voluntary insurance of liability (about 40%) and property (about 20%) predominates.

- In 2016, the amount of insurance premiums from agencies amounted to 1,180.63 billion rubles. For the same period, the amount of payments was 505.8 billion rubles.

- The predominance of the following sales channels for insurance products is observed: direct sales (30%), through agents (30%), in banks (25%).

- The insurance market is concentrated in Moscow and the Moscow region.

- Today, the state of the insurance industry in Russia can be diagnosed as stable.

Photo gallery

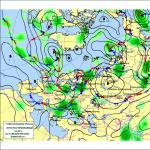

Market structure by size of authorized capital in 2015 and 2016 Insurance market concentration indicator for the period from 2010 to 2016 Key performance indicators of the insurance market over time (from 2010 to 2016) Ratio of rates of insurance premiums and payments (by quarters for 2013-2016) Structure of types of insurance and premiums of companies (in 2014-2016) Sales channels for insurance products in 2016 and 2015

The target audience

The target audience of an insurance company can be very diverse, it depends on:

- agency specializations;

- range of services provided;

- pricing policy;

- location of company branches, etc.

The main consumers of insurance services from among legal entities:

- industrial enterprises;

- trading companies;

- financial and credit institutions;

- agricultural enterprises;

- organizations operating in the service sector.

According to the level of income received, all consumers can be divided into:

- the poor (including pensioners, large families, students, people with low salaries, etc.);

- middle class (for example, car owners, tourists, small entrepreneurs);

- rich (including successful large businessmen, owners of luxury real estate, Vehicle etc.).

A businessman can target the activities of his own insurance company both to all types of clients and to a specific category of consumers.

Competitive advantages

For the insurance company to stay afloat and function successfully long years, it must have the following key competitive advantages:

- well-known and promoted brand;

- a well-thought-out assortment that takes into account the characteristics of the local market and the expected location of the agency;

- availability of both compulsory and voluntary insurance programs;

- competent pricing policy;

- a sufficient number of competent agents and other employees;

- location of company branches in high traffic areas target audience;

- prompt and friendly service;

- active work of insurance agents with potential clients;

- positive customer reviews.

Advertising campaign

- Branding. An entrepreneur must take care to create a bright trademark and logo.

- Outdoor advertising. Placing banners, streamers, billboards and other structures in crowded places.

- Corporate website. It should be a resource created and developed by a team of professionals. Information about the company, insurance products, contact details and other information is posted here.

- Promotions/presentations.

- Distribution of paper materials (including booklets, brochures, leaflets).

- Placing advertisements in newspapers/magazines, on local/central television, on the Internet (for example, banners, contextual advertising).

- Offering company services to potential clients over the phone.

- Cooperation with banking organizations, car dealerships, travel agencies and other organizations.

- to yourself;

- its merits and advantages;

- services provided, etc.

Step-by-step opening instructions

To organize your own insurance company from scratch in Russia you need:

- Analyze the market for the functioning of the future company.

- Carefully consider the package of insurance services provided.

- Create detailed business plan with calculations.

- Determine sources of financing.

- Prepare papers for registering the company's activities and obtaining a license.

- Register the agency as a legal entity.

- Apply for a license.

- Carry out company branding.

- Select premises for the head office and branches.

- Conclude purchase and sale/lease agreements for premises.

- Carry out design, construction, repair and Finishing work in the buildings of the insurance agency.

- Select staff.

- Organize advanced training/insurance training courses.

- Establish alternative sales channels for insurance services (through intermediaries).

- Conduct advertising campaign events.

- Ceremonial opening of the head office and branches.

Documentation

Key points in the insurance agency registration process:

| Name | Description |

| Authorized capital | Minimum values of the Criminal Code (as of 01/01/2017):

|

| Type of ownership | Options legal registration activities:

|

| OKVED codes | When registering a business, the founders indicate the following types of activities:

|

| Company name | According to current legislation, the name of the agency must contain the word “insurance” or its derivative |

| Licensing | Each type of insurance requires a separate permit and additional contributions to the authorized capital |

To register a company, the following documents are submitted to the tax office:

- statement;

- full and abbreviated name of the organization;

- constituent documents (including the charter and constituent agreement);

- originals and copies of passports of the founders and the director;

- TIN and registration of the general director;

- paper evidence of payment of the amount of the authorized capital;

- documents about the location of the agency's head office.

The following are submitted to the Insurance Market Department under the Central Bank of Russia to obtain a license:

- a statement expressing the founders’ intention to obtain a certain type of permission to carry out the agency’s activities;

- plastic bag constituent documents;

- a description of the rules, principles and tariffs for insurance products sold;

- registration certificate legal entity;

- information about the founders;

- information about the general director (autobiography, documents confirming his education, qualifications, work experience, etc.);

- detailed business plan;

- internal audit data;

- documentary confirmation of the amount of contributed authorized capital in the required amount;

- receipt of payment of state duty.

It will take about 3-6 months to prepare documents for obtaining an insurer's license and their consideration by the Central Bank of the Russian Federation. The validity period of the permit is unlimited and does not require renewal. As a result of successful completion of the license registration process, the company will be enrolled in the Unified State Register subjects of insurance business.

In order for the company’s activities not to be suspended, the maximum liability for an individual risk should not exceed 1/10 of the agency’s authorized capital.

Room and design

Criteria for choosing premises for the head office of an insurance company and its branches:

| Sign | Description |

| Square | For the central office – at least 200 square meters. For branches, the optimal size is about 100 square meters. |

| Location | Suitable building:

|

| Infrastructure | Main characteristics:

|

| Communications | Availability in the building:

|

Zoning of the central office of the insurance company:

| Name of premises | Approximate area, sq. m. |

| Manager's office | 20 |

| Legal department | 15 |

| Hall for receiving clients | 80 |

| 20 | |

| Agent room | 35 |

| Accounting department | 10 |

| Cash register | 10 |

| Reception area | 10 |

| Waiting area for clients | 20 |

| Staff room | 10 |

| Utility room | 30 |

| Bathrooms for staff and clients | 10 |

| Total | 270 |

Features of the design and renovation of the insurance agency office:

- It is recommended to use light colors in the interior;

- in the decoration of walls, ceilings, floors, etc., it is better to use modern building materials;

- the room should not be overloaded with furniture;

- the office should be spacious, clean and comfortable;

- Various posters and banners with information about the insurance products sold should be placed on the walls;

- furniture must have a respectable appearance;

- the central office and branches of the agency are registered in the corporate identity color scheme and the same style.

Reception area and customer waiting areas Meeting room Meeting room Example of a customer service room The waiting area Client reception area

Equipment and inventory

Equipment and inventory for equipping an insurance company consisting of one central office and five branches:

| Name | Quantity, pcs. | Approximate price, rub./piece. | Total cost, rub. |

| Computer | 35 | 20 000 | 700 000 |

| Office equipment (including printers, phones, faxes, MFPs, paper shredders, etc.) | — | — | 240 000 |

| Cash register equipment (including cash registers, banknote counters, banknote detectors, etc.) | — | — | 720 000 |

| Camera | 6 | 20 000 | 120 000 |

| Safe for storing papers | 15 | 10 000 | 150 000 |

| Safe for money | 12 | 15 000 | 180 000 |

| Furniture for the customer waiting area | — | — | 250 000 |

| Reception equipment | — | — | 1 000 000 |

| Furniture for the manager's office | — | — | 250 000 |

| Staff room equipment (including furniture, refrigerator, microwave, kettle, etc.) | — | — | 500 000 |

| Furniture for the meeting room | — | — | 500 000 |

| Equipment for utility rooms | — | — | 500 000 |

| Furniture for customer service hall | — | — | 2 000 000 |

| Bathroom equipment | — | — | 500 000 |

| Furniture for agents' room | — | — | 1 300 000 |

| Security and fire alarm system | — | — | 1 000 000 |

| CCTV | — | — | 500 000 |

| Air conditioner | 12 | 40 000 | 480 000 |

| Other equipment and inventory | — | — | 500 000 |

| Total | — | — | 11 390 000 |

Cash register equipment – 120,000 rubles Reception area equipment – 170,000 rubles Furniture for a room for insurance agents – 200,000 rubles Office air conditioner – 40,000 rubles

Staff

Since today in Russia it is problematic to find qualified personnel for an insurance agency, they will have to be trained or “lured away” from already established competitors.

The company's staff for the central office and five divisions:

| Job title | Number, people | Salary of one staff unit, rub./month. | Payroll fund, rub./month. | Payroll fund with accruals, rub./month. |

| CEO | 1 | 100 000 | 100 000 | 131 000 |

| Branch manager | 5 | 60 000 | 300 000 | 393 000 |

| Secretary | 6 | 20 000 | 120 000 | 157 200 |

| Chief Accountant | 1 | 60 000 | 60 000 | 78 600 |

| Accountants | 2 | 25 000 | 50 000 | 65 500 |

| Managers responsible for certain areas of insurance | 5 | 25 000 | 125 000 | 163 750 |

| Insurance consultants/agents | 30 | 25 000 | 750 000 | 982 500 |

| Inspectors | 3 | 50 000 | 150 000 | 196 500 |

| Cashiers | 8 | 20 000 | 160 000 | 209 600 |

| Service staff | 10 | 15 000 | 150 000 | 196 500 |

| Total | 71 | — | 1 965 000 | 2 574 150 |

Requirements for the main employees of the company - insurance agents:

- higher economic/financial education;

- Experience in the insurance industry is preferred;

- communication skills;

- competently delivered speech;

- active life position;

- ability to sell insurance services and negotiate;

- desire to learn;

- presentable appearance;

- Computer knowledge and ability to use office equipment.

The video material raises the question of how to become a professional in the insurance market. Here we tell you where specialists for this field of activity study. Filmed by the channel: “PRO BUSINESS TV”.

Financial plan

Subsequent financial planning The activities of the insurance agency are based on the following information:

| Index | Meaning |

| Number of founders | Three persons |

| Source of funds | Equity |

| Legal form of agency | Public joint stock company |

| License | For life insurers |

| Minimum authorized capital | 240 million rubles |

| Number of branches | Five branches and one head office |

| Head office location | Russia, Moscow, business center in the central part of the city |

| Branch locations | Moscow - 3 branches, St. Petersburg - 2 divisions. All representative offices are located in busy areas with high traffic of potential clients. |

| Central office area | 300 square meters |

| Average area of agency branches | 100 square meters |

| Premises | Long term rental |

| Number of employees | 71 people |

| The target audience | Individuals and companies/organizations. Income level – average |

How much does it cost to open?

The cost of opening your own insurance agency consists of the following expenses:

| Expenditures | Approximate prices, rub. |

| Amount of authorized capital | 240 000 000 |

| Registration of a license | 150 000 |

| Creation of a legal entity | 60 000 |

| Obtaining permits from regulatory authorities | 100 000 |

| Purchase of equipment and inventory | 11 390 000 |

| Acquisition of software and other intangible assets | 1 500 000 |

| Rent for premises (for 4 months) | 2 800 000 |

| Branding | 500 000 |

| Design, renovation and decoration of office and agency branches | 1 500 000 |

| Advertising costs (including website development) | 1 200 000 |

| Salary with accruals (for 3 months) | 7 725 000 |

| Consumables | 500 000 |

| Other costs | 1 000 000 |

| Total | 268 425 000 |

Regular expenses

The owner of the insurance company incurs the following monthly expenses:

| Expenditures | Approximate prices, rub. |

| Insurance payments | 39 600 000 |

| Rent | 700 000 |

| Communal expenses | 130 000 |

| Salary (including deductions) | 2 575 000 |

| Advertising | 60 000 |

| Depreciation of fixed assets | 130 000 |

| Transportation costs (fuel, vehicle maintenance, etc.) | 50 000 |

| Security agency services | 600 000 |

| other expenses | 50 000 |

| Total | 43 895 000 |

Income

The performance parameters of the insurance company were determined based on the following data:

Key indicators economic efficiency business:

Calendar plan

Opening an insurance company on your own will require not only large financial investments and knowledge, but also considerable time (8-12 months).

Schedule of the process of implementing a business idea for an insurance agency from scratch:

| Stages | 1-2 month | 3-4 month | 5-6 month | 7 month | 8 month |

| Analysis of the domestic insurance market | + | ||||

| Determining the direction and format of the business, range of services | + | ||||

| Business design | + | ||||

| Preparation of documents for opening a legal entity | + | ||||

| Agency registration | + | ||||

| Preparation of documents for obtaining a license | + | + | |||

| Checking of papers by specialists of the Central Bank of the Russian Federation (to obtain permission to carry out insurance activities) | + | + | |||

| Obtaining a license | + | ||||

| Search for premises for the central office of the company and its divisions | + | ||||

| Branding | + | ||||

| Concluding rental agreements for suitable buildings | + | ||||

| Development of design projects for agency representative offices and head office | + | + | |||

| Carrying out construction/repair/finishing work | + | ||||

| Selection, purchase, transportation and installation of company equipment | + | + | |||

| Advertising campaign | + | + | + | ||

| Search, selection, hiring and training of agency employees (including general director and chief accountant) | + | + | |||

| Obtaining permits to commission premises from supervisory services (fire inspection, SES, etc.) | + | + | |||

| Organization of alternative sales options for the company’s products (through intermediaries) | + | + | |||

| Selecting a security agency and concluding a service agreement with it | + | ||||

| Grand opening of the agency's head office and branches | + |

Risks and payback

External and internal risks of implementing a business project to open an insurance company:

| Risk factor | Description of the risk | Probability |

| Competition | An increase in the number of market participants will lead to a decrease in demand for insurance services and will entail an increase in marketing costs | High |

| Tightening requirements of government agencies for insurance agencies | The reason for the closure of many participants of this market is the growing number of requirements placed on companies by the state. Including:

| Average |

| Decrease in solvency of the population and legal entities | The unstable economic situation in the country may cause a reduction in incomes of the population and private businesses. This, in turn, will lead to a decrease in demand for insurers' services. | Average |

| Low qualifications of agents, administrative and management personnel and other specialists | Today in the labor market it is quite difficult to find competent and competent workers for the insurance industry. They will either have to be lured away from competitors or trained on their own. | High |

| Simultaneous occurrence of multiple insurance events | This risk may lead to the ruin of the company. Company specialists must carefully approach the issue of developing the range of services provided and setting tariffs for them. | Low |

The payback period for the insurance business will be 4-4.5 years.

In this material:

Insurance – profitable business. The competition in this market is serious, but by investing once and organizing everything correctly, you can get a solid monthly profit. Find out how to open an insurance company, what you need to start a business, and how to get maximum profit with minimal investment.

Insurance business for a beginner: the basics

Let's figure out how relevant the insurance business is, what pros and cons it has, and what risk factors can overtake you when opening such a company.

Relevance

You can often hear: “No one is immune from...”. And this applies to absolutely everything. People insure everything - from real estate to their own lives. A master will insure your eyesight, a singer will insure your voice, a perfumer will insure your sense of smell, etc. Today even pets are insured.

Insurance is so popular that people even insure their health against certain diseases (for example, tuberculosis). Moreover, there is both voluntary and compulsory insurance.

The decision to open an insurance company will always be the right one, since such a service was, is and will be relevant in the market.

Pros and cons of the insurance business

Positive aspects of opening an insurance company or agency:

- High business profitability;

- Increasing need for insurance among various segments of the population;

- The ability to “customize” your services to a specific region of the country as flexibly as possible;

- You can open a franchise company and offer services on behalf of a reputable company.

Flaws:

- Difficulties with registration large number documents at the stage of opening a company;

- A large amount for the formation of authorized capital - from 20 million rubles;

- The need to constantly monitor the market and competitors so that the company always stays afloat;

- The risk of various unforeseen situations arising due to the frequent appeal of people for insurance payments.

Remember! The insurance business is a profitable, but very risky business. Therefore, you need to initially weigh all the pros and cons, and only after that start organizing your business.

Risks

The risks of an insurance company's business plan are divided into categories.

current data is provided after ordering the power supply

current data is provided after ordering the power supply Market

Problems can arise at any stage of the formation/operation of an enterprise:

- Decreased demand for certain services due to reductions in insurance payments;

- Unfair competition from other companies;

- Rising prices for equipment and materials that are extremely important for the normal functioning of the company;

- Increasing the number of branches of competing firms;

- Increased fee for public utilities, rental premises, etc.

Financial

Such risks include delays in payment for goods by counterparties, choosing the “wrong” investor, problems with paying loans, collateral, etc.

Internal risks

The main problems may lie directly within the company's employees themselves. It is imperative to assess these risks, because the slightest conflicts and misunderstandings between employees can lead to serious problems:

- Strikes. Because of them, work can simply stop indefinitely. A common reason is late wages;

- Disclosure of trade secrets. All important data will be transferred to competitors;

- Court proceedings, fines, inspections. May arise due to the selection of unprofessional employees.

The most profitable types of insurance

One of the innovations is insurance of large sums of money, lying in bank accounts. This money covers very substantial deposits, and the cost of such insurance is quite high.

Property insurance will always be popular. Moreover, both ordinary apartment owners and owners of country villas apply - the price of such property can be several million dollars.

The third profitable type of insurance is auto insurance. This includes both compulsory insurance of the MTPL type and other voluntary types, which allow you not to worry about the theft of your car or its damage by ill-wishers.

Organization plan

To open an insurance company, you need to go through several mandatory stages, and take each one as seriously as possible. These include:

- Registration of an enterprise;

- Rent of suitable office space;

- Selection of equipment and furniture;

- Recruitment.

Enterprise registration

It is mandatory to register a legal entity. The company can have any form of ownership: LLC (limited liability company), CJSC or OJSC (closed or open joint-stock company).

From the types of activities you need to choose one that contains the word “insurance”. But if it is planned to carry out examinations as part of the work, then they must also have a direct connection with insurance.

Important! More on preparatory stage you need to decide whether the company will provide life insurance. This is important because, subject to the provision of such a service, the authorized capital must be at least 20 million rubles.

After registering a company, you need to obtain a license allowing you to provide insurance services. To do this, you need to submit to the Ministry of Finance:

- Constituent documentation of the company;

- Business plan;

- Rules for the provision of insurance services;

- Tariff calculations.

The director of the enterprise will need to confirm his qualifications, work experience, and received legal education. It takes about a year to obtain a license, and you will need to pay a state fee for this process. If everything goes “smoothly”, the company will be included in the state register of insurance companies, and you can immediately begin work.

Office space

The office must have a representative appearance that inspires confidence - no one will take their money to a company whose office is located in an old garage. Every client wants to come to a company with a respectable image and good reputation.

The area of the premises must be chosen so as to accommodate not only the working staff, but also to make visiting clients feel comfortable. If the company is its own, then it must have a head office (at least 600 sq. m.), and city branches (200-300 sq. m. each).

The premises must be renovated, clean air, and an atmosphere that inspires confidence. The design of the offices should be the same and consistent corporate style which creates a good impression.

Furniture and equipment

Should form a positive opinion among visitors. It’s worth buying new, modern furniture highest quality. For each workplace you need to purchase equipment:

- Modern computer;

- A printer;

- Telephone;

- Fax machine;

- Scanner.

It is necessary to provide each employee with reliable access to the Internet and a dedicated telephone line. Must be in the office Appliances: kettle, refrigerator, microwave, etc.

Employees

You need to hire professionals who can not only serve visitors, but quickly solve pressing problems. Neglect interviews, studying resumes, etc. not worth it.

If examinations are carried out, then you can not recruit experts into your staff, but hire a specialist “from the outside”, concluding an official deal with him. But, it is important to carefully study the company you plan to contact and check all its documentation.

Advertising campaign: attracting the maximum number of customers

You need to promote your company based on the package of services provided. For example, if health insurance is advertised, then it is worth contacting large companies directly market enterprises who want to improve working conditions for their employees.

The most popular channels for attracting customers are banks and car dealerships. The downside is that most insurance companies use them. Initially, you will have to reduce prices for services in order to win your first customers.

The third channel for attracting clients is expanding the range of services provided. You can use a cross-selling insurance scheme when several insurance options are offered at once.

The money side of the issue

As part of the business plan for an insurance agency or company, you need to calculate the initial and ongoing costs, and then predict the expected profit.

Initial investment and running costs

For each specific case, the initial amount will be different. It also depends on the region of Russia. But, speaking of approximate initial investments, it is worth mentioning the amount from 7,000,000 rubles.

What does it include:

- Rent of premises – 50,000 rubles. in a year;

- Preparation of documentation – 700-900 thousand rubles;

- Renovation of the premises and purchase of equipment – 2 million rubles;

- Advertising campaign – 3 million rubles;

- Administrative costs – 1 million rubles.

Total: 7 million rubles.

Ongoing costs will consist of:

- Issues wages employees;

- Phone/Internet payments;

- Payments for utilities;

- Unforeseen expenses (for example, due to equipment breakdown);

- Printing advertising literature;

- Promoting the company on the market;

- Etc.

Profitability

In order for profits from the insurance business to constantly grow, you need to carefully monitor all changes in the market and monitor the activities of competitors. This is the only way to create an effective marketing plan, and quickly make changes to the list of company services.

Important! To increase profits, it is not necessary to raise prices for services; it is much better to expand the list of services. The average profit with this approach in a city with a population of 1 million or more will be 5-10 million rubles.

Read more about the profitability of the insurance business and payback periods

If the business plan of the insurance company was prepared according to all the rules, then the profitability of the business will be about 2% per month of the invested funds. To assess profitability as accurately as possible, you need to divide monthly expenses by profit. On average, investments in an insurance company will pay off in about 4-5 years.

Attention! The free business plan offered for download below is a sample. A business plan that best suits the conditions of your business must be created with the help of specialists.

When opening an insurance company, you need to understand that Russian market insurance services are well developed. Most consumers are accustomed to trusting proven companies with a long history, but a young company may face great difficulties.

You need to start any project with planning - drawing up a business plan. In this case, it is necessary to define a special segment in the insurance market - not occupied niche, or a segment in which supply does not meet growing demand.

The business plan of an insurance company is drawn up according to a standard structure.

Summary

It is necessary to provide basic information about the company and the project:

- — organizational and legal form;

- - field of activity;

- — license;

- - premises;

- — primary costs;

- - net profit;

- — profitability;

- - payback period.

To provide insurance services, you must register as a legal entity, clearly stating in the charter the types of insurance services provided. The minimum authorized capital will depend on the list of services provided.

The insurance company must also obtain a license. For licensing, it is necessary to undergo a certification procedure, which includes confirmation of the qualifications and reputation of the first managers, verification of constituent documents and documentation describing the types of planned insurance activities.

Description of the industry and company products

Indicate the demand for your insurance services in this region and in the selected segment of the insurance market. Place emphasis on a wide range of services, flexible pricing policy, qualified personnel, service, and individual approach.

It is also advisable to provide the annual expected growth of the company.

Marketing research

It is necessary to carry out market research and calculate possible revenue.

The business plan of an insurance company involves drawing up a marketing plan. He must disclose insurance policies, products, prices, advertising costs.

To adequately enter the insurance market, in search effective solutions The focus should be on innovative insurance products and targeted advertising strategies should be developed.

It is advisable to conduct a survey of the population regarding their desire to insure themselves with a new company; its results can give an approximate idea of the level of demand for your services.

The marketing plan must justify the possibility of achieving planned sales volumes.

Financial plan

It is necessary to determine:

- — fixed assets;

- - intangible assets;

- — primary costs;

- — costs of paying for third-party services;

- — labor costs and taxes;

- — total estimated costs for the year;

- - profit for the year.

You also need to create a short balance sheet.

Good to know!

We respect your choice, but we want to remind you that the least risky, relatively easy and comfortable start of a business can be organized under the wing of a successful company on a franchising basis. We invite you to get acquainted with "Catalog of profitable franchises".

Why starting a business with a franchise is easier and more convenient can be found out from a selection of articles published in the section: "Articles about franchising"

Organizational plan

This section of the insurance company’s business plan provides the company’s management structure and personnel information. Typically there are two groups of employees: office workers and insurance agents.

Risks

Lack of demand is the most dangerous risk for an insurance company. Taking into account the risks, it is necessary to calculate the company's break-even point.

We provide you with a free standard business plan for an insurance company that will help you start your own business providing insurance services.

Watch the video: “OA Business Secrets: Andrey Skvortsov”

The idea of starting an insurance business requires a careful approach if you want to earn real income. First of all, keep in mind that the business plan of an insurance company should be based on the fact that it is necessary to conduct a full market analysis of existing insurance services in advance.

Important points in organizing an insurance company:

- - the authorized capital of the establishment of a legal entity must be at least 120 million rubles;

- - only a citizen of the Russian Federation who meets certain requirements can manage a company;

- - insurance activities are permitted only after obtaining a license; in order to obtain permits for a type of activity, insurance rules developed for a specific company will be required;

- - to obtain permission to carry out activities, it is necessary to have a central office of the company.

Decide what type of insurance you will engage in; the amount of authorized capital will depend on this. For life insurance, a capital of 240 million rubles will be required, and for reinsurance, at least 480 million.

Main organizational stages.

The Russian market is already crowded with insurance companies. A detailed study of the market will make it possible to find a less filled niche. It would be wiser to choose one of the types of insurance, or services that are just gaining popularity among consumers.

As an idea, you can use, for example, a lightning strike during a thunderstorm or a meteorite fall.

When you have chosen the type of insurance you will engage in, you should decide on the scale of your company’s work: city, region, entire country. The formation of the staffing table will depend on this.

There is another way to determine the scope of activity. Choose a specialization, for example, in water transport.

Without attracting third-party investments, you will not be able to implement your business plan. It is for this reason that such a document should be as detailed and understandable as possible for future co-founders.

Be prepared that registering a legal entity is a fairly lengthy process. You will also need a license from the Ministry of Finance, which can take from four to twelve months to obtain.

The most important.

In the insurance business, an important factor is the stable and justified motivation of the organizers and their like-minded people to achieve a specific level of sales.

Probably, more important than the authorized capital, there will be competently selected personnel capable of self-motivation and seeing a real perspective before failure. Even in the first stages, pay attention to the psychological aspect.

Your investors should be prepared in advance for a long-term placement of their capital and not a quick return on it.

For reference.

The number of insurance agencies in Russia has decreased by twenty percent. According to data as of the end of January of this year in the unified state. The register of insurance entities included 459 insurance agencies, 14 of which are reinsurance agencies.

Despite the fact that the insurance market is sufficiently developed, the current situation in this sector is such that opening a new insurance agency may be difficult. profitable idea based on the needs of the target audience.

In the capital and others major cities often seek insurance services from jewelry companies. Insurance of financial risks arising during the joint construction of residential or non-residential facilities is in demand in megacities. You can always find your niche for opening an agency by conducting a thorough analysis of the insurance market for available services. To do this, taking into account all the features outlined below, they create a business plan for an insurance agency. One of the possible options is a franchise or branch of an already popular agency. Such a project could be a good starting point in the future for a new and independent agency.

Features of the insurance agency business plan project

The essence of the project is to create an agency for insurance of life and health, property and other valuables. The main goal of the business plan is to assess the prospects and economic efficiency of the project to create an insurance agency from scratch. The plan can be used as a commercial proposal when negotiating with potential investor or when receiving a commercial loan.

The project implementation is planned for 2 years.

During this period it is planned to achieve the following goals

— creation of a profitable enterprise;

— meeting the needs of the target audience in the field of life and property insurance for both individuals and legal entities;

- obtaining high profits.

Basic financial aspects new business are as follows:

- the period within which the company will recoup everything starting investments and will reach the level of profitability – 2 years. Under favorable conditions - earlier;

— total cost project (the amount of a commercial loan that is planned to be issued at the beginning of the activity) - 1 million 200 thousand rubles;

— loan payments will begin from the first month of the enterprise’s activity. During the first two years, the total amount of payments will reach 82 thousand rubles;

— interest rate on the loan is 17.5%. In the future, this figure may be reduced;

- general economic effect from the sale of services over the indicated period, under favorable conditions, will reach 84 million.

In general, starting a business in the insurance industry will be characterized by a low level of costs. But in order to avoid losses and have the opportunity to develop in the chosen direction, you need to think carefully about all areas of activity and draw up a clear plan for all upcoming stages.

Features and prospects of working as an insurance agent - in the video:

Features of the insurance company's activities

By offering life insurance and various types of property as its main services, the company immediately identifies the approximate circle of its clients. The target audience of the insurance company is very wide. First of all, these are private individuals who insure their lives in case of illness or death, accident or work injury. The second, more extensive and highly paid category is insurance of movable and real estate individuals, as well as organizations and enterprises.

Many insurance companies offer too many types of services at once. This may complicate entering the market, as it will require too much time and money, as well as attracting a large number of specialists. Therefore, it is worth starting with a limited list of services, with a main focus on serving individuals and providing a limited range of services to enterprises and organizations.

The operating principle and procedure of an insurance company largely depends on the type and scale of its activities. But in general, the general procedure includes the following responsibilities of the insurer:

— drawing up insurance programs of all types provided for in the strategy. At this stage, all financial aspects are calculated and a specific insurance proposal is developed;

- signing an agreement with the client - an individual or organization;

— receipt from the policyholder of the first insurance payment, of which 15% is received by the insurer as a commission and payment of expenses incurred, and the remaining amount goes to the insurance reserve. The insurance reserve, in turn, is divided into 2 parts: 70% for the accumulative reserve and 15% for the risk reserve. Both reserves are invested in instruments provided by law;

— upon the occurrence of an insured event, agency specialists review all submitted documentary evidence and make a decision on the advisability of making insurance payments, their amount and procedure.

The procedure for insurance and payments may differ slightly, but the principle is standard for all organizations. It is determined by relevant legislation. True, organizations can have different sales channels - both direct and brokerage channels are active in the market. At the same time, in the domestic market the share of the brokerage channel for sales of insurance services is still quite low and amounts to less than 4 percent. The Russian insurance system is characterized to a greater extent by the participation of non-insurance intermediaries - banks, travel agencies or car dealers. Vivid examples are MTPL and comprehensive insurance policies.

Internet insurance today also represents not only direct sales of insurance services. Over the past few years, the number of Internet agents performing intermediary functions has increased significantly.

Registration

The insurance company can be immediately registered as an LLC. There are other types of legal entities. But a limited liability company will be the most convenient and profitable for a start-up organization. When drawing up the charter for the LLC being opened, you need to list in detail the planned services of the agency, not forgetting about additional and auxiliary offers. When filling out the documents, you must provide all activity codes of the new company. For this purpose, a specialized OKVED classifier. In it, one or more suitable activity codes are selected. No matter what they may be additional types activities, they must be related to insurance and must be separately indicated when drawing up the application. For example, this could be damage assessment, which has a direct connection with insurance.

A mandatory condition for creating an LLC is the contribution of the authorized capital. Its size largely depends on the services provided by the campaign. The higher the value of the services (for example, life insurance of the client), the larger the authorized capital. But the minimum amount is 10 thousand rubles.

Other documents required when opening a legal entity are the charter, the decision to create an LLC (or another form), the decision to appoint a manager and, if there are several founders, the minutes of the founders’ meeting.

License. Certificate

The agency can act on the basis of a special permit - a license for the services provided. All legal requirements regarding types and forms of insurance, as well as licensing and certification - in a specialized federal law“On the organization of insurance business in the Russian Federation” ().

You must first pass the certification required by law. This process is quite complex, it takes place under the guidance and control of the Ministry of Finance and requires a long time - certification usually takes up to a month. To complete it you will need a package of documents, including:

- Insurance rules.

- Documentation for opening a campaign.

- Tariff calculations.

The specificity of the campaign is that everyone the new kind insurance requires the preparation of new documents. In addition, the head of the company must confirm his qualifications in this field. The success of the undertaking will depend on the work experience of the manager himself and the number of positive reviews about his activities.

The result of the preparatory work will be the inclusion of the enterprise in the specialized state register after receiving a license. The entire licensing process will take up to six months, so you need to take care of this in a timely manner.

Regulatory documents that must be studied before starting work:

Stages of creating a business

The basic sequence of actions for opening an insurance agency is as follows:

— development of a strategy for the future company;

— drawing up a marketing and financial plan;

— renting or purchasing office space, equipping it and preparing it for opening;

More detailed plan insurance agency includes the following stages:

| Stages | Execution conditions | Deadlines |

| Start of the project | 1 – 2 year | |

| 1 month project | First 30 banking days | |

| Receiving credit funds | Availability of a mandatory package of documents | 1 month |

| Entry into the state register, registration with administrative and tax authorities | Concluded investment agreement | From 1 to 30 calendar days |

| Selecting a location, preparing documentation | Preliminary work | 1 month |

| Purchase of equipment | Conclusion of an investment agreement | Up to 30 calendar days |

| Equipment installation | Receiving investment funds | Up to 30 calendar days |

| Hiring employees | Production activities | Up to 30 calendar days |

| Training | The end of the stage of organizing the production process | Up to 1 month |

| Advertising | Within 1 month | Up to 1 year |

| End of the project | 12 – 24 months |

Premises and equipment

The main condition for the selected office space is good access to it and the availability of convenient parking for clients’ personal vehicles. There should be good transport links nearby - a metro station and public transport stops for clients who do not have their own car. At the entrance, a noticeable sign is required that will orient visitors and serve as an advertisement.

The room may be small, but spacious enough to accommodate several employees and the opportunity to meet with clients. Maximum area - 150 sq. m, but maybe less. The design of the office as the face of the agency is very important. This issue needs to be given a lot of attention: there should be no bright, emphasized decorative details here. Clients are more attracted to a strictly business-like appearance, which speaks of the company’s reliability.

Purchasing office equipment will be an important stage in opening a company. At the first stage you need to purchase:

— desks and chairs for employees in the quantity necessary to provide furniture for the entire team;

— chairs, armchairs or sofas for waiting by clients;

- computers with high-quality software for all specialists;

— other office equipment – printers, scanners, copy machines;

- connection to telephone and Internet.

To create a comfortable atmosphere, the workplaces of specialists should be demarcated. You can equip several separate small offices. If this is not possible, the room is zoned using screens.

Staff

At the time of opening the agency, there should be no more than 10-20 employees on staff. A larger staff will be too expensive to maintain on a monthly basis. In addition, a start-up insurance agency is unlikely to be able to count on a large number of clients. The team will include:

- manager,

- accountant,

- lawyer,

- insurance agents.

The main responsibility of insurance agents is to independently find clients to provide them with insurance services. Otherwise, you will have to wait a long time for the company to develop. According to the preliminary plan, in the first 2 years, as the company develops, it will be necessary to increase the team to 100 - 150 full-time and freelance agents.

As business opportunities expand, the number of employees and insurance agents will also grow. And for the business to develop, there must be insurance agents on staff who can convince and sell insurance services. The more services are sold, the better the insurance agency will do. The company's profit will depend on this.

To accurately recruit professional staff, you need to get acquainted with a large number of applicants and select only the most professional and experienced. To retain new employees, you need to create the most profitable terms labor, interest agents with a positive bonus, possible career advancement, and a good percentage of the services they sell. You can also go by training beginners using special training. It is advisable to use these two types of work with agents simultaneously. Be sure to hire several experienced insurance specialists who do not require training.

The dress code of employees is one of the optional, but important conditions. The strict appearance emphasizes the authority of the company and the professionalism of its specialists.

Marketing. Basic strategies for attracting clients

A marketing campaign should begin with studying the state of the market, current trends and dynamics. Crisis phenomena, which periodically influence the general state of the economy, are important in the functioning of the insurance market. Thus, in 2008–2009 and 2013–2014, the insurance market significantly reduced its activity, which is natural due to the international and domestic crisis. At the present time, the echoes of the last crisis are still being felt by most insurance agencies, especially small market participants. To cope with this problem and retain customers, it is necessary to offer more favorable conditions, comprehensive insurance packages, and necessarily improve the quality of services.

Statistics show that despite some negative trends, the insurance market is still growing and expanding. A particularly popular area is life insurance: every year this service is in increasing demand. If we analyze the insurance situation in the country as a whole, we can conclude that as a result of the crisis, the total number of companies on the market has decreased. At the same time, only strong and competitive participants remained in this segment.

The driving force of an insurance agency forward is the advertising of each individual insurance service, since the work of an insurance agency is the sale of insurance services.

With each specific insurance service, they need to go to the target audience of customers, sometimes mixing them. A profitable solution would be a “two in one” offer - a discount when insuring two objects at the same time.

With small starting capital and the impossibility of giving immediately a wide range of insurance services, you can focus on one type of service. It is important that this direction is not yet widespread enough on the market or is completely new. In the absence of competition, you can achieve high results in business development. And as the business develops in the future, add new insurance services.

According to statistics, the following advertising methods work best:

— Internet: creation and promotion of a website, posting information about insurance services on thematic websites, using banner and contextual advertising;

— Media, especially the use of thematic publications. This will allow you to reach the target audience as much as possible;

A good method would be to offer services directly to potential clients - organizations and enterprises - in the form of online newsletters with information about current service packages. Customer reviews are one of the best methods progress in this area. This is due to the high cost of insurance services and the low level of consumer confidence in little-known and untested companies.

How in short term open your own insurance business - in the video:

Finance

First, you need to count on a minimum capital of 20 million rubles. Having such an amount will allow you to confidently start a business and not be afraid of a temporary lack of profit.

When opening an insurance campaign, you must count on the following main expense items:

| Expense item | Expenses per month | Expenses for the year | One-time costs | Total expenses for the year |

| Rent (purchase) of premises (from 40 sq.m.) | 30000 | 360000 | 60000 | 420000 |

| Purchase of equipment, including computers and office supplies | 106000 | 106000 | ||

| Buying a car | 430000 | 430000 | ||

| Website creation, hosting, scripts | 120000 | 120000 | ||

| Advertising expenses | 45000 | 540 thousand | 540 thousand | |

| Salary | 332000 | 3.9 million | 3.9 million | |

| Taxes | 99800 | 1198000 | 1198000 | |

| Additional expenses | 71560 | 71560 | ||

| Total | 407 thousand | 4.9 million | 788 thousand | 5.7 million |

Thus, the financial result regarding investments during the first year of the company’s operation is as follows: to open and develop an insurance company during the designated period, you need to have an amount of up to 6 million rubles available. This condition is relevant for small organization numbering several insurance agents. If a larger organization is initially opened, this amount can double. However this project provides for a gradual expansion of the company's scale.

The financial year begins in January. Just from the beginning of the year the deadline for implementation will be counted tax payments. The list of taxes for LLCs under the standard taxation system will be as follows:

The income part of the business plan should begin with drawing up an approximate pricing policy for the future agency. This indicator is determined taking into account the cost of the organization and the current pricing policy in the industry. Average tariffs for insurance services in the country today are as follows:

By dividing the entire 2-year period of opening and developing a business into 2 main stages - investment and operation, you can draw up the following service provision plan:

| Period | Type of service | Volume of production and sales for 1 month. (PC.) | price, rub. | Sales revenue, rub. |

| 1 – 12 months of investment | Life and health insurance | 20 people | From 120 thousand | From 2.4 million |

| 1 – 12 months of investment | Other insurance | 100 objects | From 17 thousand | 1 million 680 thousand |

| Life and health insurance | 50 people | From 134.4 thousand | From 6.7 million | |

| 13 – 24 months of operation | Other insurance | 200 objects | From 18.5 thousand | From 3.7 million |

If in the future the current market trends continue, that is, an increase in the volume of services provided in the amount of 10–22% per year, then the annual growth in the volume of sales of the company’s services will reach more than 58 million rubles per year.

To overcome difficulties at entering the market and smoothly pass the entry barrier, it is imperative to attract highly qualified specialists and use high-quality equipment. Competent marketing strategy and a well-thought-out advertising campaign. To find the best specialists, it is necessary to allocate approximately 1 month for the search for personnel, selecting the best through interviews.

Risks

When planning the income of an enterprise, be sure to take into account all possible risks.

The main ones

— high level of competition in the insurance industry;

— lack of proper trust among potential clients, especially private individuals;

— high level of competition in the industry for positions of top managers and specialists in other areas;

— high level of capitalization of investments.

The conclusion about opening an insurance agency as a type of business may be as follows. First of all, such an enterprise is potentially highly promising and profitable, characterized by high profitability and constantly increasing demand among potential clients. All these advantages take place with proper organization of the company’s work and a timely advertising campaign. From weak points this industry - high competition, maintaining mistrust among the target audience and lack of specifics in legislative framework. In the future, the prospects for the insurance business will depend on the general economic situation in the country, the quality of legislative regulation of this issue, as well as competent business planning by each entrepreneur.

The main features of opening an insurance agency are in the video: