Risk in the field of entrepreneurial activity. Entrepreneurial risk: its essence, types and features in Russia. What are the types of risks?

risk is key element entrepreneurship under market economy. Characteristics risk - uncertainty, surprise, uncertainty, the assumption that success will come. In conditions of political and economic instability, the degree of risk increases significantly. In the current crisis conditions, the problem of increasing risks is very relevant.

Risk is the possibility of adverse situations in the course of implementing the plans and executing the budgets of the enterprise.

IN entrepreneurial activity it is important to correctly allocate risks between counterparties. The partner in the project who is best able to calculate and control risks should become responsible for the risk. Risk is shared during development financial plan project and contract documents.

There are the following main types of risks:

Production risk is associated with the production and sale of products (works, services), the implementation of any types of production activities. This type of risk is most sensitive to changes in the planned volumes of production and sales of products, planned material and labor costs, to price changes, marriage, etc.

IN modern conditions in Russia, the production risk is high, so production activities have become the most risky.

There are risks in this area:

Failure to comply with business contracts

Changes in market conditions, increased competition,

The occurrence of unforeseen costs,

Loss of company property.

Commercial risk arises in the process of selling goods purchased by an entrepreneur (rendering services). In a commercial transaction, it is necessary to take into account such factors as: an unfavorable change (increase) in the price of purchased means of production; reduction in the price at which products are sold; loss of goods in the process of circulation; increase in distribution costs.

financial risk may arise during the implementation of financial entrepreneurship or financial (monetary) transactions. Financial risk, along with factors characteristic of other types of entrepreneurial risk, is also affected by such factors as the insolvency of one of the parties to a financial transaction, restrictions on foreign exchange transactions, etc.

Cause investment risk there may be a depreciation of the investment and financial portfolio, consisting of own and purchased securities.

Market risk is associated with possible fluctuations in market interest rates, national currency(s) or foreign exchange rates.

Sources of political risk can be a decrease in business activity of people, non-execution of adopted legislative acts, instability tax rates, violation of payments and mutual settlements, alienation of property or Money.

Losses from risk in entrepreneurial activity are divided into:

Material losses are costs not provided for by the project or direct losses of material objects in kind (buildings, structures, transmission devices, products, materials, raw materials, etc.).

Labor losses - the loss of working time caused by accidental or unforeseen circumstances.

Financial losses arise as a result of direct monetary damage (unforeseen payments, fines, payments for overdue loans, additional taxes, loss of funds or valuable papers).

Losses of time occur if the process of entrepreneurial activity is slower than envisaged by the project.

Special types of losses - losses associated with damage to the health and life of people, environment, the prestige of the entrepreneur and other unfavorable social and moral-psychological factors.

The means of resolving entrepreneurial risks are their avoidance, retention, transfer, and reduction of the degree.

Risk avoidance refers to the simple avoidance of risk-related activities. However, avoiding risk for an entrepreneur often means forgoing profit.

Risk retention implies leaving the risk to the investor, i.e. on his responsibility.

The transfer of risk means that the investor transfers the responsibility for the financial risk to someone else, such as an insurance company.

Risk reduction is the reduction of the probability and amount of losses.

When choosing a specific means of resolution financial risk The investor must proceed from the following principles:

1) you can not risk more than your own capital can afford;

2) one must think about the consequences of the risk;

3) you can not risk a lot for the sake of a little.

The implementation of the first principle means that, before investing, the investor must:

Determine the maximum possible amount of loss for this risk;

Compare it with the amount of invested capital;

Compare it with all your own financial resources and determine whether the loss of this capital will lead to the bankruptcy of the investor.

The implementation of the second principle requires that the investor, knowing the maximum possible loss, determine what it can lead to, what is the probability of the risk, and make a decision to reject the risk (i.e., from the event), to take the risk on his own responsibility or on the transfer of risk to the responsibility of another person.

The operation of the third principle is especially pronounced in the transfer of financial risk. In this case, it means that the investor must determine the ratio between the insurance premium and the sum insured that is acceptable to him. The risk must not be withheld, i.e. the investor should not take the risk if the loss is relatively large compared to the savings in insurance premiums.

To reduce the degree of financial risk, various methods are used:

Diversification is the dispersion of investment risk, i.e. distribution of invested funds among various investment objects that are not directly related to each other.

Limitation is the setting of a limit, i.e. limits on expenses, sales, loans, etc. Limitation is an important means of reducing the degree of risk and is used by banks when issuing loans when concluding an overdraft agreement; by an economic entity - when selling goods on credit, using traveler's checks and eurocheques, etc.; by the investor - when determining the amount of capital investment, etc.

Insurance, the essence of which lies in the fact that the investor is ready to give up part of the income, just to avoid risk, i.e. he is willing to pay to reduce the risk to zero. In the process of insurance, funds are redistributed between the participants in the creation of the insurance fund: compensation for damage to one or several insurers is carried out by distributing losses to all. The number of policyholders who made payments during a given period is greater than the number of those who receive reimbursement.

Securitization is the participation of two banks in a lending operation. A credit transaction is carried out in two stages: 1) development of conditions and conclusion of a credit agreement (transaction); 2) granting a loan to a borrower. The essence of securitization is that these two stages are performed by different banks.

The following types of entrepreneurial risk are known.

Production risk is associated with the production of products, goods, services, the implementation of any type of production activity. Among the reasons for the emergence of such a risk are a decrease in the size of production, an increase in material and other costs, the payment of increased interest, deductions, taxes, etc.

Commercial (commodity) risk arises in the process of selling goods and services produced or purchased by the entrepreneur. Its reasons are a decrease in the volume of sales due, for example, to changes in the market situation, an increase in the purchase price, an unforeseen decrease in the volume of purchases, losses of goods in the circulation process, an increase in distribution costs.,

Financial risk arises in the sphere of relations of the enterprise with banks and other financial institutions. It is usually measured by the ratio of borrowed funds to own: the higher this ratio, the more the company depends on creditors, the higher the financial risk, since the restriction or termination of lending, tightening of credit conditions lead to a halt in production due to lack of raw materials, etc.

Financial risks are divided into two types: those associated with the purchasing power of money and capital investment (investment risks).

The risks associated with the purchasing power of money include inflation and currency risks.

The group of investment risks is very extensive and includes the following risks: systemic, selective, liquidity, credit, regional, sectoral, enterprise, innovative.

Systemic risk is the risk of deterioration of the conjuncture (fall) of any market as a whole. It is not associated with a specific investment object and represents a general risk for all investments in this market (stock, currency, real estate, etc.).

Liquidity risk is associated with the possibility of losses in the sale of an investment object due to a change in the assessment of its quality, for example, any product, real estate (land, buildings), securities, etc.

Credit risk is the risk that a borrower (debtor) will be unable to meet its obligations. Examples include deferring loan repayments or freezing bond payments.

Regional risk is associated with the economic situation of certain regions.

Industry risk is associated with the specifics of individual sectors of the economy, which is determined by two main factors: exposure to cyclical fluctuations and the stage of the industry's life cycle.

Enterprise risk is associated with a specific enterprise as an investment object. In addition, enterprise risk includes the risk of fraud. For example, it is possible to create false companies in order to fraudulently attract funds from investors or joint-stock companies for speculative gambling on the quotes of securities.

Innovation risk is the risk of loss associated with the fact that an innovation, a new product or service, new technology, the development of which can be spent very significant funds, will not be implemented or will not pay off.

Risk factors

Macro environment factors:

Political factor - it means the political image of the country, the likelihood of changes in political attitudes, the likelihood of changes in legislation, the degree of dependence of entrepreneurship on government intervention, the likelihood of the execution of political declarations, the degree of influence of political factors on the state of the economy;

Technological risks - risks associated with the emergence of new fundamental developments, new production technologies, new requirements for the safety of technologies, technological risks can also be classified as market risks, in which case it will include the cost of production technology in this industry, the introduction of new equipment in our industry , tightening economic regulations;

Macroeconomic factor - it combines such factors as inflation, changes in the exchange rate, the dynamics of real incomes of the country's population, the level of discount rates;

Environmental factor - new environmental standards.

Market factors:

technological factor;

Financial factor - the cost of credit resources, their availability, the degree of financial discipline of our counterparties;

Investment factor - the need for investment, the amount of diversity in the quality of religious projects, the degree of discipline of contractors;

Environmental factor;

Demand factor – existing demand, potential demand;

Competition factor - the number and market shares of each of the competitors, the image of competitors, the image of the company's products, types of competition policy;

social factor.

It is expedient to analyze labor markets, raw materials.

Factors of the internal environment:

Social risks - risks associated with satisfaction with wages, relationships at the enterprise;

image risks;

Technological risks - the degree of wear, the quality of equipment, the rationality of technology, the amount of marriage;

Financial factors - the effectiveness of financial investments, the effectiveness of the system for distributing financial resources;

criminal factors.

Due to the fact that entrepreneurial risk has a subjective basis, expressed in decision-making by the entrepreneur himself, and an objective basis (the influence of the external environment), it is advisable to consider the successes and failures of entrepreneurial activity taking into account external and internal factors.

External factors are those conditions that an entrepreneur cannot change, but must take into account when carrying out his activities, since they affect the state of his affairs. External factors include:

direct impact factors that directly affect the results of business activities, such as legislation, tax and financial systems, competition, etc.;

factors of indirect influence that do not have a direct impact, but contribute to its change, for example, world events, economic instability, political changes.

Internal factors are those conditions that an entrepreneur can change in the course of his activities and thus minimize possible risks. Internal factors include the range and quality of goods sold; the equipment used, the amount of expenses of the enterprise, etc.

The division of risk factors according to the degree of manageability is essential:

controlled factors depend on the quality of the enterprise. These include: the level of labor organization, the efficiency of resource use, etc.;

hard-to-control factors depend on the background of the enterprise and in the study period are hardly or partially amenable to influence. These include relationships in the team, qualifications and number of staff, etc.;

uncontrollable factors cannot be changed, but can only be taken into account. These include climatic and political conditions, exchange rates, etc.*

Risk classification.

Risk classification means the systematization of a set of risks based on some signs and criteria that allow combining risk subsets into more general concepts.

The most important elements underlying the risk classification are:

- time of occurrence;

- main factors of occurrence;

- nature of accounting;

- the nature of the consequences;

- sphere of origin and others.

By the time of occurrence, risks are divided into retrospective, current and prospective risks. Analysis of retrospective risks, their nature and methods of reduction makes it possible to more accurately predict current and future risks.

According to the factors of occurrence, risks are divided into:

- Political risks- these are risks caused by a change in the political situation that affects entrepreneurial activity (closure of borders, a ban on the export of goods, military operations in the country, etc.).

- Economic (commercial) risks- these are risks caused by adverse changes in the economy of the enterprise or in the economy of the country. The most common type of economic risk, in which private risks are concentrated, are changes in market conditions, unbalanced liquidity (inability to fulfill payment obligations in a timely manner), changes in the level of management, etc.

According to the nature of accounting, risks are divided into:

- External risks include risks that are not directly related to the activities of the enterprise or its contact audience ( social groups, legal and (or) individuals who show potential and (or) real interest in the activities of a particular enterprise). The level of external risks is influenced by a very large number of factors - political, economic, demographic, social, geographical, etc.

- Internal risks include risks caused by the activities of the enterprise itself and its contact audience. Their level is influenced by the business activity of the enterprise management, the choice of the optimal marketing strategy, policies and tactics, and other factors: production potential, technical equipment, level of specialization, level of labor productivity, safety measures.

According to the nature of the consequences, the risks are divided into:

- Pure risks(sometimes they are also called simple or static) are characterized by the fact that they almost always carry losses for entrepreneurial activity. The causes of pure risks can be natural disasters, wars, accidents, criminal acts, incapacity of the organization, etc.

- Speculative risks(sometimes they are also called dynamic or commercial) are characterized by the fact that they can carry both losses and additional profit for the entrepreneur in relation to the expected result. Reasons for speculative risks may be changes in market conditions, changes in exchange rates, changes in tax legislation, etc.

Risk classification in terms of the sphere of origin, which is based on the spheres of activity, is the largest group. In accordance with the areas of entrepreneurial activity, they usually distinguish: production, commercial, financial and insurance risk.

Production risk associated with the failure of the enterprise to fulfill its plans and obligations for the production of products, goods, services, other types of production activities as a result of the adverse effects of the external environment, as well as the inadequate use of new equipment and technologies, basic and working capital, raw materials, working hours. Among the most important reasons for the emergence of production risk, one can note: a decrease in expected production volumes, an increase in material and / or other costs, the payment of increased deductions and taxes, poor delivery discipline, destruction or damage to equipment, etc.

Commercial risk is the risk arising in the process of selling goods and services produced or purchased by the entrepreneur. The reasons for commercial risk are: a decrease in the volume of sales due to changes in market conditions or other circumstances, an increase in the purchase price of goods, loss of goods in the circulation process, an increase in distribution costs, etc.

financial risk associated with the possibility of a firm failing to meet its financial obligations. The main causes of financial risk are: depreciation of the investment and financial portfolio due to changes in exchange rates, failure to make payments.

insurance risk- this is the risk of the occurrence of an insured event stipulated by the terms and conditions, as a result of which the insurer is obliged to pay insurance compensation (sum insured). The risk results in losses caused by inefficient insurance activities both at the stage preceding the conclusion of the insurance contract and at subsequent stages - reinsurance, the formation of insurance reserves, etc. The main causes of insurance risk are: incorrectly determined insurance rates, gambling methodology of the insured.

Forming the classification associated with production activities, the following risks can be distinguished:

- Organizational risks- these are the risks associated with the mistakes of the company's management, its employees; system problems internal control, poorly developed work rules, that is, the risks associated with the internal organization of the company's work.

- Market risks- these are the risks associated with the instability of the economic situation: the risk of financial losses due to changes in the price of goods, the risk of a decrease in demand for products, translational currency risk, the risk of loss of liquidity, etc.

- Credit risks- the risk that the counterparty will not fulfill its obligations in full on time. These risks exist both for banks (the risk of non-repayment of the loan), and for enterprises with receivables, and for organizations operating in the securities market

- Legal risks- these are the risks of losses associated with the fact that the legislation was either not taken into account at all, or changed during the period of the transaction; the risk of inconsistency between the laws of different countries; the risk of incorrectly drawn up documentation, as a result of which the counterparty is not able to fulfill the terms of the contract, etc.

- Technical and production risks- risk of damage to the environment (environmental risk); the risk of accidents, fires, breakdowns; the risk of disruption in the functioning of the facility due to design and installation errors, a number of construction risks, etc.

In addition to the above classifications, risks can be classified according to the consequences:

Tolerable risk is the risk of a decision, as a result of which, if not implemented, the company is threatened with loss of profit. Within this zone, entrepreneurial activity retains its economic feasibility, i.e. there are losses, but they do not exceed the expected profit.

Critical Risk- is the risk at which the company is threatened with loss of revenue; those. the critical risk zone is characterized by the danger of losses that obviously exceed the expected profit and, in extreme cases, can lead to the loss of all funds invested by the enterprise in the project.

catastrophic risk- the risk at which there is an insolvency of the enterprise. Losses can reach a value equal to the property status of the enterprise. This group also includes any risk associated with a direct danger to human life or the occurrence of environmental disasters.

In entrepreneurial activity, various types of risk: industrial, ecological, investment, credit, technical, commercial, financial, political.

Table 7 - a brief description of risks

| View | Subspecies | Characteristic | |

| CLEAN | natural-natural | Risks associated with the manifestation of the elemental forces of nature | |

| Environmental | Associated with damage to the environment: pollution, destruction of biological species | ||

| Political | Associated with the political situation in the country and state intervention in the normal course of production and trade processes | ||

| Social | Customs, traditions, mentality of the population of the country | ||

| SPECULATIVE | Property | Risks associated with the possibility of loss of property due to theft, sabotage, negligence, extortion, industrial accidents | |

| Production | Risks associated with loss from production shutdown due to destruction and damage to fixed and working assets | ||

| Operating | Transport | Associated with the transportation of goods: cargo - causing damage to the transported cargo; Casco - causing damage to the vehicle | |

| Trading | Associated with losses due to delayed payments, refusal to pay, non-delivery of goods. | ||

| Informational | Damage related to information leakage, inaccuracies or lack of information | ||

| Organizational | Losses due to inefficient organization of business, incorrect selection of employees, insufficient competence | ||

| Financial risks | Cash | Inflationary risk - cash incomes depreciate in terms of real purchasing power faster than they grow. Currency risk - the danger of currency losses with a change in the exchange rate. Liquidity risk - associated with the possibility of losses in the sale of securities or other goods due to changes in the assessment of their quality and consumer value | |

| Investment | Loss of profit risk - non-receipt of profit as a result of non-implementation of an event. Risks of reduced profitability - as a result of a decrease in the amount of interest and dividends, the risk of non-payment of debt by the borrower. Risks of direct financial losses - losses from exchange transactions, wrong choice of the type of capital investment, risk of bankruptcy |

In business activities, such types of risks:

1) Industrial risk - the danger of damage to the enterprise and third parties due to disruption of the normal course of the production process: the danger of damage or loss of production equipment and vehicles, the destruction of buildings and structures as a result of the influence of such external factors as forces of nature and malicious acts. The most common and serious is the risk of failure of machinery and equipment, the occurrence of an emergency.

This can happen in industrial facilities as a result of events:

- natural character(earthquake, flood, landslide, hurricane, tornado, lightning strike, storm, volcanic eruption, etc.);

- technogenic character(wear and tear of buildings, structures, machinery and equipment, errors in their design or installation, malicious acts, personnel errors, damage to equipment during construction and repair work, falling aircraft etc.);

- mixed(violations of the natural balance as a result of man-made activities, for example, the occurrence of an oil and gas fountain during exploratory drilling of wells).

2) Environmental risk - the likelihood of civil liability for causing damage to the environment, as well as a threat to the life and health of third parties. They can arise during the construction and operation of production facilities and are an integral part of industrial risk. Environmental damage is expressed in the form of pollution or destruction of forest, water, air and land resources (for example, as a result of a fire or construction works), as well as in the form of damage to the biosphere and agricultural land.

3) Investment risk is associated with the possibility of shortfall or loss of profit during the implementation of investment projects. In this case, the object of risk is the property interests of the person investing his funds, i.e. investor.

The group of investment risks includes the following subspecies:

- risk of lost profits - this is the risk of indirect financial damage (loss of profit) as a result of failure to implement any event (insurance, investment).

- the risk of a decrease in profitability arises as a result of a decrease in the size of interest and dividends on portfolio investments, deposits and loans.

4) Credit risk. In this case, there are risks associated with the possible non-repayment of the loan amount and interest on it, i.e. credit risks. Non-return can occur for various reasons: incomplete construction, changes in the market and general economic situation, insufficient marketing study investment project, emergency events.

For the lender, not only the fact of repayment of the loan amount and interest is important, but also the timing of repayment. The delay in terms leads to an actual decrease in the profitability of the issued loan, and, taking into account inflation and lost profits, it also leads to losses. Thus, for the creditor there is a risk of direct losses in case of non-repayment of the loan amount or part of it, and the risk of indirect losses associated with a delay in paying the principal and interest on it.

5) Technical risks accompany the construction of new facilities and their further operation. Among them are construction and installation and operational. Technical risks can be an integral part of industrial, business and investment risks.

Construction and installation risks include the following:

Loss or damage to building materials and equipment due to adverse events - natural disasters, explosions, fires, malicious acts, etc.;

Violations of the functioning of the object due to errors in the design and installation;

Causing physical damage to personnel involved in the construction of the facility.

6) Commercial risks. Distinguish between internal and external commercial risks. External ones are connected with infliction of losses and non-receipt by the entrepreneur of the expected profit, due to violation of their obligations by counterparties, or due to other circumstances beyond their control. Internal depend on the ability of the entrepreneur to organize production, marketing of products (sale of goods), etc.

Commercial risk can be classified according to a number of criteria. Irreducible risk can be divided into compensated And uncompensated. Compensable will be one that cannot be reduced, but can be assessed and compensated through measures such as, for example, a price premium.

According to the uniqueness of the action of risk factors, risks are divided into static And dynamic. Static risk- this is the risk of loss of real assets due to damage to property, as well as loss of income due to the incapacity of the organization. This risk can only lead to a negative or zero result. Dynamic risk- the risk of unexpected changes in the value of fixed capital due to the adoption of commercial management decisions. Such changes can lead to both losses and gains.

1) Financial risks. Financial risks can be considered as a special group of risks within a wide range of (commercial) entrepreneurial risks. Financial risks arise in the process of managing the finances of an enterprise. The most common are currency, interest and portfolio risks.

Under currency risks is understood as the probability of losses from changes in exchange rates in the process of foreign economic, investment activities in other countries, as well as when receiving export credits. Under interest rate risks refers to the probability of losses in the event of changes in interest rates on financial resources. Portfolio risks show the influence of various macro- and microeconomic factors on the assets of an entrepreneur or investor. The portfolio of assets may consist of stocks and bonds of enterprises, government securities, term liabilities, cash, insurance policies, real estate, etc.

8) Country risks arise when entrepreneurs and investors carry out their activities on the territory of foreign states. Business income may decrease in the event of an unfavorable change in the political or economic situation in the country.

9) Political risks are the most important component of country risks. Their essence lies in the possibility of a shortfall in income or loss of property of a foreign entrepreneur or investor due to changes in the socio-political situation in the country (changes in legislation that prevent the execution of international contracts or the repatriation of foreign exchange earnings; changes in the legal framework that make it difficult to carry out entrepreneurial activities, etc.)

Most common subspecies of entrepreneurial risk :

- Transport risks associated with the transportation of goods by any transport, there are two types: cargo - damage to the cargo, and Casco - causing damage to the vehicle.

- Trading risks associated with losses due to delayed payments, refusal to pay, non-delivery, short delivery of goods, with the quality of goods.

- Information risks associated with damage due to leakage commercial information intended for sale (removal of protections from programs, theft and unauthorized access to databases, leakage of "know-how"), with the leakage of current business information and inaccuracies in the use of information or its absence.

- Organizational risks associated with losses due to inefficient organization of business management, incorrect selection of employees, abuse of office by employees or insufficient competence to perform assigned tasks.

- Property risks associated with the probability of loss of property of an economic entity due to theft, sabotage, extortion, negligence, industrial accidents.

- Inflation risk- money incomes depreciate in terms of real purchasing power faster than they grow.

- Deflationary risk- a fall in the price level worsens economic conditions entrepreneurship and leads to a decrease in income.

- Currency risks represent a risk of currency losses associated with changes in the exchange rate during foreign economic, credit and other foreign exchange transactions.

Search and apply new methods of business management;

Maintain constant control over the business.

In any decision that is made in business, there is a risk. Therefore, anyone who is going to choose entrepreneurship as their profession must first determine their attitude towards risk.

This will allow you to avoid many mistakes even when choosing a field of activity and a future project: either it will be quite risky, but with significant growth potential, or you should limit your activities to certain types of small businesses, characterized by greater stability and reliability. Currently, in order to find out which group you belong to in relation to risk, there is a significant set of various tests and a fairly large number of specialist consultants.

Purpose of the lecture: Assess and disclose the essence of entrepreneurial (economic) risk

Lecture questions:

1. The essence of entrepreneurial (economic) risk. Types of risks and losses, their classification.

2. Assessment of business risks.

3. Business risk management

1. The implementation of entrepreneurial activity due to the uncertainty of economic situations and the volatility of the economic environment is to some extent risky. In this regard, there is uncertainty in obtaining the expected end result.

The behavior of an entrepreneur within the framework of economic freedoms provided by market relations is realized through a competitive strategy. In this case, the main task is not only to search for and consolidate goods and services on the market, but also to resist the actions of competing entrepreneurs who are prone to ousting the opponent from the market. Consequently, this circumstance, together with losses of various kinds in the course of production and economic activities, leads to the fact that the risk becomes an integral part of the financial and commercial operations of the enterprise. Therefore, it must be foreseen, trying to reduce it to the minimum possible value.

Carrying out production economic activity, the enterprise is forced to study the risk arising from the production, purchase, sale of products, with the goal of not compensating for losses from the risk, but also preventing damage.

Entrepreneurial risk – the danger of a potentially possible, probable loss of resources or a shortfall in income of the expected value compared to those calculated based on the potential capabilities of the enterprise.

Risks are classified according to different criteria (classification features):

- for reasons of occurrence;

– by functional types and branches of business;

– according to the possibility of insurance, the level of admissibility, etc.

In each case, depending on the goal, one or another classification is used. For clarity, the types of entrepreneurial risks can be presented in Table 1.

Table 1– Risk classification

Production risk associated with the production of products, goods and services, with the implementation of any types of production activities. The main reasons for the production risk are forced interruptions in production; failure of production assets; loss of working capital; untimely delivery of equipment, raw materials, etc.; production risk associated with the possibility of a company failing to fulfill its obligations under a contract or agreement with a customer.

financial risk arises in the sphere of relations between an entrepreneur and banks and other financial institutions. The reasons for financial risk are the high ratio of borrowed and own funds, dependence on creditors, passivity of capital, simultaneous placement of large funds in one project; financial (credit) risk , associated with the possibility of a firm failing to fulfill its financial obligations to an investor as a result of using debt to finance the firm's activities.

Commercial risk arises in the process of selling goods and services produced or purchased by the entrepreneur. The reasons for commercial risk may be unexpected changes in market conditions, in business conditions, etc.

There are also certain types of risks to which entrepreneurial firms may be exposed at different stages of their activities, such as:

– legal risk associated with poor quality of legislative acts and unexpected changes in legislation;

– investment risk caused by poor-quality study of feasibility studies, an unforeseen increase in the cost of the project, tightening of laws on environmental protection; and is also associated with the possible depreciation of the investment and financial portfolio, consisting of both own securities and acquired ones;

– market risk, associated with possible fluctuations in market interest rates, both of its own national currency and foreign exchange rates;

– insurance risk associated with the formation of the insurance fund, the management of the latter, as well as its own property, cash and personnel;

– innovation risk arises from uncertainties in this area (starting from the development of an idea, its implementation in a product or technology, and ending with the implementation of the corresponding product on the market).

Losses from risk in entrepreneurial activity are divided into material, labor, financial, time losses, special types of losses.

Material losses - these are costs not provided for by the project or direct losses of material objects in kind (buildings, structures, products, semi-finished products, materials, raw materials, components).

Labor losses - loss of working time caused by accidental or unforeseen circumstances; the use of time norms instead of technically justified ones (the unit of measurement is “man-hour” or “man-day of working time”).

Financial losses - arise as a result of direct monetary damage (payments not provided for by the entrepreneurial project, fines, payments for overdue loans, additional taxes, loss of funds or securities). They can also be the result of non-receipt or shortage of money from the sources provided for by the project, non-repayment of debts, etc.

Waste of time arise in the event that the process of entrepreneurial activity is slower than that envisaged by the project (measured in hours, days, decades, months, etc.).

To the number special types of losses include: losses associated with damage to the health and life of people, the environment, the prestige of the entrepreneur and other adverse social and moral and psychological factors. A special group of special types of losses are losses from the impact of unforeseen factors of a political nature. They bring confusion into the existing economic conditions of people's lives, disrupt the rhythm of production and economic activity, generate increased costs and reduce income.

2. In the process of risk management, the key point is the stage of its assessment, at which it is calculated and affects the results of business activities.

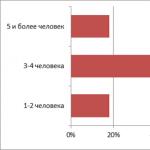

Risk assessment- this is a quantitative or qualitative determination of the magnitude (degree) of risk. There are no universal methods for assessing risk. All of them have their advantages and disadvantages and are far from ideal. The choice of any particular method of evaluation depends on the specific situation and the personality of the entrepreneur. It is advisable to conduct a qualitative-quantitative, i.e. combined, business risk assessment. Qualitative and quantitative assessment of entrepreneurial risk is shown in Figure 1.

Picture 1 -Qualitative and quantitative risk assessment

Qualitative assessment represents the identification of all possible risks. Qualitative assessment can be relatively simple, its the main task- identify risk factors, stages of work during which the risk arises.

When conducting a risk assessment, it is necessary to determine degree of risk. The risk may be:

– allowable - there is a threat of complete loss of income from the implementation of the planned facility;

– critical - non-receipt of not only income, but also coverage of losses at the expense of the entrepreneur’s funds;

– catastrophic possible loss of capital, property and bankruptcy of the entrepreneur.

Quantification aims to quantify the risks, conduct their analysis and comparison. Various methods are used to quantify risk. Various methods are used in quantification. Currently the most common are:

Sometimes a qualitative and quantitative assessment is carried out on the basis of an analysis of the influence of internal and external factors: an element-by-element assessment is carried out specific gravity their impact on work this enterprise and its monetary value is determined. This method is quite laborious in quantitative analysis, but in qualitative analysis it brings undoubted results.

IN absolute terms risk can be determined by the size of possible losses in material (physical) or cost (monetary) terms.

IN relative terms risk is defined as the sum of possible losses related to a certain base, in the form of which it is most convenient to take either the total cost of resources for a given type of entrepreneurial activity, or the expected income.

Qualitative risk assessment can be performed using a statistical method. The main tools of this assessment method are mean expected value, variance, standard deviation, coefficient of variation.

Variation- change in quantitative indicators when moving from one result option to another.

Dispersion - a measure of the deviation of an actual value from its mean value.

Thus, the degree of risk can be measured by two criteria: the average expected value, the volatility (variability) of the possible result.

Average expected value - this is the value of the result (event) that is associated with an uncertain situation. It is a weighted average of all possible outcomes, where the probability of each outcome is used as the frequency, or weight, of the corresponding value. Thus, the result that is supposedly expected is calculated.

Method expert assessments. This method is usually implemented by processing the opinions of experienced entrepreneurs and professionals. It differs from statistical only in the method of collecting information to build a risk curve.

The calculation-analytical method is based on the construction of a distribution curve for the probability of losses and the assessment of entrepreneurial risk indicators.

3. Since entrepreneurial activity is often associated with the possibility of negative consequences, adverse results, there is a need to develop methods and means that reduce the likelihood of their occurrence or localize negative consequences. This kind of action in economics is called risk management system. This is a special kind of activity aimed at mitigating the impact of risk on the final results of an entrepreneurial firm.

The concept of risk management includes three main positions:

1) Identification of the consequences of the entrepreneur's activities in a risk situation;

2) The ability to respond to the possible negative consequences of this activity;

3) Development and implementation of measures by which the negative results of the actions taken can be neutralized or compensated.

Risk management means search for compromise when making decisions. High-quality risk management increases the chances of an entrepreneurial firm to succeed in the long term, significantly reduces the risk of deterioration in its financial condition.

Table 2 presents a classification of the main methods of enterprise risk management. Some of the listed methods guarantee risk reduction in the future, some - immediately. Some methods may be characterized as measures of direct impact on the magnitude and probability of risk realization, others - as measures of indirect (indirect) impact.

Table 2 -Classification of risk management methods

| Risk Prevention Methods | Avoidance Methods risk | Risk localization methods | Risk Diversification Methods | Methods to reduce the economic consequences of risk |

| Acquisition of necessary risk information Strategic planning activities of the enterprise Active, targeted marketing Forecasting the development of the external environment Staff training and instruction Implementation of preventive measures (emergency, fire fighting, etc.) | Refusal from unreliable partners Search for guarantors Refusal from risky projects Conservation of property Dismissal of incompetent employees | Creation of subsidiaries for the implementation of risky projects Creation of special (with a separate balance sheet) structural units Conclusion of agreements on joint activities for the implementation of risky projects | Distribution of risks between participants in individual projects (co-executors) Diversification of sales and supplies Diversification of investments Diversification of activities Distribution of risk over time | Limiting Self-insurance (stocking and reservation) Mutual insurance Insurance |

In Kazakhstan's economic practice, the methods of avoiding and localizing risk are the most common. These methods are used by leaders of many manufacturing enterprises, who refuse the services of unreliable intermediaries, try not to expand the circle of partners, work only with reliable counterparties.

Since many risk management methods are not only complementary, but also alternative, based on a specific situation, each enterprise must make the most economically justified choice between them.

Questions for self-control:

1. Contractual relations of entrepreneurs with business partners

2. Anti-crisis development strategy for small and medium-sized businesses

1. Kruglova N. Yu. Fundamentals of business (entrepreneurship): textbook / N. Yu. Kruglov. – M.: KNORUS, 2010. – 544 p.

2. Lapusta M. G. Entrepreneurship: textbook - M.: INFRA-M, 2013. -384 p.

3. Nabatnikov V.M. Organization of entrepreneurial activity. Textbook / V.M. Nabatnikov. - Rostov-na D.: Phoenix, 2011 - 256 p.

Topic 4. Business - planning in the entrepreneurial system

activities

Purpose of the lecture: Develop an enterprise planning process

Lecture questions:

1. Business planning process

2. Business plan - implementation plan entrepreneurial projects

3. Methodology for compiling and developing a business plan

1. Planning in entrepreneurial activity should be seen as a process of early adoption of an interconnected set of decisions through which common decisions are implemented in a situation where it is assumed that the desired state in the future is unlikely to occur unless special measures are taken, and by taking appropriate measures, one can increase the likelihood of a favorable outcome.

Planning- this is an activity that consists in the development and practical implementation of plans that determine the future state of the economic system of the enterprise.

From the point of view of the enterprise, at the microeconomic level, planning - it is a way of carrying out an action based on conscious, volitional decisions of the subjects of microeconomics, a mechanism that replaces prices and the market.

There are two planning forms company activities:

- planning the company's activities in the market;

- internal planning.

As a rule, these aspects of planning are interrelated.

It should be noted that truly planning can be rational only when the relationship of a firm with counterparties in the market is not random and one-time, but becomes stable and long-term.

– Enterprise planning allows:

- to carry out a clear coordination of the ongoing efforts to achieve the goals;

- Encourage managers to more specifically define their goals and ways to achieve them;

- to determine the performance indicators of the company, necessary for subsequent control;

- prepare the enterprise for sudden changes in market conditions;

- clearly articulate the duties and responsibilities of all managers of the firm.

Modern market relations make their changes not only in the concept of "planning", but also specify the principles, goals, methods and types of planning.

Like any management activity, planning should be based on certain principles. It is the principles that determine the structure and content of the planning system, the nature of the planning process.

Principles:

1) Continuity. It is necessary to constantly plan and adjust plans, as goals and situations can change.

2) Coordination and integration. Coordination covers the interaction of all organizational units of the same level, and integration is necessary for the coherence of actions between units of different levels.

3) Consistency. Enterprise in external environment must be taken into account as a whole.

4) Scientific. It is necessary to apply scientific methods in planning

Each businessman, starting his activity, must clearly understand what awaits him in the near future, namely: what will be his need for financial, material, labor and intellectual resources, what are the sources of their acquisition, and also be able to clearly calculate the efficiency of the use of resources during the operation of the firm (enterprise).

That is, entrepreneurs will not be able to succeed if they do not clearly and effectively plan their activities, constantly collect and accumulate information both about the state of target markets, the position of competitors on them, and about their own prospects and opportunities.

In recent years, the concept of "business plan" has been rapidly introduced into the economic life of entrepreneurial structures. Such a document, as a rule, is prepared to attract external sources of financing, investments: borrowed funds from the lender (bank and other loans, bonded loans), attracted financial resources of the investor (from the sale of shares, shares and other contributions), budget investment allocations. There is another function of the business plan - planning the entire economic activity of the company. Ideally, the same business plan should perform both of these functions, but in practice, a business plan focused on obtaining external financing and a business plan for internal use have significant differences, both in structure and in content.

Business plan- this is a plan for the implementation of business operations, company actions, containing information about the company, product, its production, sales markets, marketing, organization of operations and their effectiveness.

The purpose of developing a business plan- plan the economic activity of the company for the near and distant periods in accordance with the needs of the market and the possibilities of obtaining the necessary resources.

– The objectives of the business plan are:

- formulation of long-term and short-term goals of the company, strategies and tactics for achieving them;

- determination of specific areas of activity of the company, target markets and the place of the company in these markets;

- the choice of assortment and the determination of indicators of goods and services that will be offered by the company to consumers;

- assessment of production and non-production costs;

– determination of the composition of marketing activities for market research, sales promotion, pricing, etc.;

- assessment of the financial position of the company and the correspondence of the available financial and material resources to the possibilities of achieving the set goals, etc.

– The business plan performs the following main functions , namely:

is a tool by which an entrepreneur can

evaluate the actual results of activities for a certain period;

– can be used to develop the concept of doing business in the future;

– is a tool for acquiring financial resources;

- is a tool for implementing the strategy of the enterprise.

Thus, the business plan allows you to analyze the possibilities of the enterprise and justify the choice of priority goals, i.e. determine the strategy of the company.

Types of business plans.

Based on the market situation and the purpose of drawing up, business plans may be different.

They are developed in different modifications depending on the purpose:

– by business lines(products, works, services, technical solutions);

– by enterprise in general (new or existing).

A business plan can be aimed at both the development of an enterprise and its financial recovery. The activities of the entire enterprise or its individual division can also be planned.

The business plan should be prepared taking into account the following recommendations:

1) Brevity - a summary of the most important for each section of the business plan.

2) Accessibility in presentation and understanding - The business plan should be understandable to a wide range of people.

3) Not overloaded with technical details.

4) Persuasiveness, conciseness, awakening the partner's interest.

5) Compliance with certain standards - the business plan should be accepted by the reader and convenient in terms of the method of its preparation.

The structure of the business plan, which is a fairly complex document, is important. Sections of the business plan should cover all aspects of the enterprise. Although outwardly business plans may differ from each other, the composition of their sections, in essence, remains practically the same, although the form may vary depending on the type of problem being solved.

In accordance with the UNIDO international methodology for a business plan The following indicators and forms of input information are required:

1. investment costs;

2. production and sales program;

3. average headcount workers;

4. current costs for the total output:

- material costs;

- labor costs and social security contributions;

– maintenance and repair of equipment and vehicles;

– administrative overheads;

- the cost of selling products;

5. Structure total costs by types of products;

6. working capital needs;

7. funding sources - share capital; loans, etc.

Such indicators and forms of information are suitable when using any of the accepted systems for modeling investment projects.

As a rule, a business plan consists of the following sections:

1) Concept, review, summary.

2) Current situation and brief information about the enterprise.

3) Characteristics of the business object.

4) Market research and analysis.

5) Organizational plan.

6) Production plan.

7) Marketing plan.

8) Potential risks.

9) Financial plan.

10) Applications.

Making a business plan begins with the preparation title page, which should provide information about where, when and by whom this document was compiled. The name of the project is also indicated here, which should clearly and concisely formulate the idea embodied in the business plan.

After the title page, there should be a table of contents that reflects the structure of the business plan. This is the nomenclature of sections or paragraphs.

Table 1 -The main sections of the business plan and the content of each section

| Business plan sections | Contents of the business plan section |

| Concept, overview, summary | This is a concise, quick-read summary of information about the intended business and the goals that the enterprise sets for itself, starting a business or developing an existing one. In fact, the concept is a shortened version of the business plan itself. The summary should reflect the following main points: - business opportunities; business attractiveness; importance for the enterprise and the region; - necessary financial resources(own or borrowed); - payback period of the project; - possible term of repayment of borrowed funds; - investment conditions; - expected profit and its distribution. The order of presentation of the concept is quite free, but it must begin with the main goal of the proposed business (as a rule, this is to generate income) and the purpose of the business plan being developed. The business concept (summary) is drawn up at the end of writing a business plan, but is at the beginning. |

| Current situation and brief information about the enterprise | In the section describing situation at present and giving brief information about the enterprise, the following points are reflected: - the main events that influenced the emergence of ideas for the business plan; - the main circumstances and problems facing managers; the state of the market and the position to be achieved. Further, in a concise form, basic information about the enterprise is given - the date of foundation, legal form, founders, legal address, etc. |

| Characteristics of the business object | In this section, it is necessary to note the focus of the business plan (products, works, services, creation of a new enterprise, development of an existing one, financial recovery). Also here it is necessary to note the importance of the product for consumers, its uniqueness. It is also desirable to characterize the functionality and features of the product. Ends the description section key factors, which should determine the success of the proposed business, etc. |

| Market research and analysis | In this section, it is desirable to determine the priorities that guide the consumer when buying: quality, price, time and accuracy of delivery, after-sales service, etc. It is necessary to segment the market, determine the size and capacity of markets for the company's products. It is necessary to analyze how quickly products and services will establish themselves on the market and justify the possibility of its further expansion, as well as the main factors influencing this. Tracking and evaluating competitors is very important. It is necessary to identify and analyze their strengths and weak sides. It is necessary to determine the possible volume of sales in physical and monetary terms, etc. |

| organizational plan | Description of the legal form, organizational structure management, characteristics of the management team, work with personnel, material and technical security of management. It must clearly define job descriptions top managers, their role in management process, as well as how the interaction of services and departments will be carried out, etc. |

| Production plan | When writing it, one should take into account: supply (providing); technological cycle; equipment service; possibilities for improving technology. The production plan reflects the production process. If individual operations are outsourced to a subcontractor, this should be shown. It is advisable to present the production process with an indication of its structure in terms of labor intensity. need to reflect the need for industrial premises and their area, as well as the production area of the enterprise, you need to indicate the need for additional equipment and material resources, etc. |

| marketing plan | The program of comprehensive market research to be carried out during the implementation of the project: determination of the total volume and range of products sold, broken down by project implementation periods, areas for improving products, taking into account the passage of stages of its life cycle, packaging requirements, appearance; justification pricing policy, sales planning, its stimulation; planning an advertising campaign, service, marketing control system, etc. |

| Potential risks | This section is especially important, since the risk factor has a great impact on the financial and economic activities of the enterprise. This should be a summary of all possible problems, which may complicate the implementation of the project, the definition of a set of preventive measures, scenarios of behavior in the event of adverse events, etc. |

| Financial plan | The purpose of the financial plan is to determine the effectiveness of the proposed business: a consolidated balance of income and expenses, a plan for cash receipts and expenses, a balance sheet plan at the end of the year in its traditional form, a plan for the sources and use of funds, etc. |

| Applications | Documents used in the preparation |

Questions for self-control:

1. Features in the development of a business plan

2. The role of competition in entrepreneurial activity

1. Fundamentals of entrepreneurship: tutorial/ IN AND. Brunova [and others]; ed. IN AND. Brunova; SPbGASU. - St. Petersburg, 2010. - 106 p.

2. Pereverzev M.P. Entrepreneurship and business: Textbook / M. P. Pereverzev, A. M. Luneva; ed. M.P. Pereverzeva. - M.: INFRA-M, 2013. - 176 p.

3. Entrepreneurship: textbook. /V.Ya. Gorfinkel, V.B. Polyak, V.A. Shvandar, M: UNITY - DANA, 2009 (Golden Fund of Russian textbooks).

Send your good work in the knowledge base is simple. Use the form below

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

Similar Documents

The essence of entrepreneurial risk and its classification. Objective and subjective reasons for entrepreneurial risks. Definition and functions of entrepreneurial risk. Classification of business risks. Risk Mitigation Methods.

course work, added 05/03/2003

Risks as an integral element of entrepreneurial activity, an incentive for the efficient use of capital: classification, scales and levels, factors of influence. Principles and stages of business risk management, the main mechanisms for their neutralization.

term paper, added 03/30/2011

The value of risk in entrepreneurial activity. Functions of entrepreneurial risks, features of their classification and characteristics of types. Entrepreneurial risks in Russia, their insurance. Evaluation, calculation and ways to reduce business risks.

term paper, added 12/06/2013

term paper, added 06/24/2015

Basic tricks financial analysis and their classification into traditional and mathematical. Risks in entrepreneurial activity. Risk indicators and methods for its assessment. Algorithm integrated assessment entrepreneurial risks, means of their resolution.

test, added 03/13/2010

Entrepreneurship as an integral element of the modern market economic system, the order and patterns of its formation, legal framework activities. Methods and ways of motivating the development of entrepreneurial activity in modern Russia.

abstract, added 07/25/2010

Concept and classification of risks. Losses taking place in entrepreneurial activity, causes of entrepreneurial risk. Preference map between expected return and riskiness of the project. Risk management mechanism and ways to reduce it.

term paper, added 06/16/2011

Risks in entrepreneurial activity, their types and causes. Planning for minimization and protection against risks. List of possible risks. Industry average labor costs. Calculation technological equipment. The cost of fixed assets.

control work, added 04/01/2009