How to write a business case example for a bank. We draw up a feasibility study (feasibility study) of the project

The feasibility study of an investment project is an integral part of any investment project, as a preliminary stage in assessing its feasibility. The feasibility study has much in common with other documents assessing the feasibility of investing in a project, with and.

The difference between a feasibility study and an investment memorandum is that an investment memorandum contains a justification for investments in a project and has the main goal of attracting investors to it, while a feasibility study is developed for “internal use” to determine the feasibility and feasibility of implementing an investment project.

The difference between a feasibility study and a business plan for an investment project lies in the degree of elaboration of the project. A feasibility study is, in essence, an enlarged calculation of the main technical and economic indicators of an investment project, the purpose of which is to justify its feasibility. The business plan is based on a more thorough analysis of the investment project and, in addition, is a guide to its implementation. The structure of a feasibility study is not much different from a business plan. In some cases, the feasibility study does not contain a number of sections of the business plan.

A feasibility study of an investment project often appears as a response to a request from the management of an enterprise or the customer of an investment project for a preliminary assessment. The intended purpose of the feasibility study determines the composition of its sections. So, for internal use, the feasibility study does not contain a section “Marketing Market Research”, since enterprise managers first want to know what the effectiveness of the project is, the main financial indicators without assessing the market. The feasibility study for the project customer contains all sections of the business plan, including marketing research of the product market.

Composition of the feasibility study

The feasibility study consists of sections reflecting the essence of the investment project and a description of the possibility of its implementation at a given enterprise.

- Any feasibility study begins with a presentation of the enterprise, its general characteristics, the level of technical and technological equipment, place in the market of its products, and a general economic assessment of the enterprise’s activities.

- Since the feasibility study is primarily a technical justification, its most important section is the description of the technical and technological components of the investment project. If we are talking about the innovative component of the project, then the idea of the project and its technical implementation must be described in detail.

- Description of the production structure of the enterprise and determination of the possibilities for implementing the project on this basis. Determining the necessary changes in the production structure, including the purchase of equipment and technology for the production of new products.

- Determination of resource requirements: material and labor. The need for materials, raw materials and components is determined. Possible resource providers are being considered. The quantity and quality of labor resources for the implementation of the investment project are determined. Sometimes the level of qualifications of employees turns out to be an obstacle to the implementation of an investment project.

- The level of current costs for research and production of products for the investment project is determined. The factory cost of future products is determined, based on aggregated calculations of costs per unit of production.

- Determination of total costs per unit of production and calculation of the profitability of its production. Calculation of EBITDA and profit from project implementation.

- Calculation of project performance indicators, including NPV indicators, project payback period and project internal rate of return IRR.

- An analysis of the environmental component of the project, its compliance with environmental protection requirements and other environmental indicators is carried out.

- Conclusion on the feasibility of implementing an investment project, supported by economic efficiency indicators.

The feasibility study in accordance with the methodology of UNIDO (United Nations Industrial Development Organization), in addition to those mentioned above, contains the following sections:

- market analysis and choice of marketing plan;

- placement of the investment object on the ground and its environment;

- project implementation schedule;

The structure of this feasibility study is more like a business plan. And in fact, this is also a business plan. This is developed at the pre-investment stage of the project. Therefore, the term “Feasibility Study” is used less and less often in investment design documents. Most customers require a business plan for the project.

Below is an example of a feasibility study for the construction of a thermal power plant for an urban settlement.

Feasibility study for the construction of mini-thermal power plants in the urban settlement. "Oktyabrsky" on JENBACHER cogeneration units.

1. Capital investments

Capital investments in construction:

- equipment and construction and installation work—RUB 1,756.647 million.

- Networks - 47 million rubles.

- total -1,803.647 million. rub.

Start of construction - 01/01/2011 Construction period is 1 year.

2. Sources of financing

Financing of capital investments is carried out through borrowed and investment funds.

The lending scheme provides for the attraction of credit funds at an annual rate of 9%.

Interest payments begin in 2011, and loan repayment is carried out after the equipment is put into operation.

The frequency of interest and principal payments is monthly.

Receipts, payments for loan repayments and debt servicing are shown below in Table 1.

Table 1

Receipts, payments for loan repayment and debt servicing (million rubles)

3.Production program.

The main type of products is electrical and thermal energy. Annual production volume:

- electricity - 306,532,800 kW/h;

- heat - 441,537,600 kW/h.

4. Production costs

Annual production costs were determined in accordance with Chapter 25 “Organizational Income Tax” of the Tax Code of the Russian Federation, as well as current industry regulations.

Fuel component of production costs

The price of gas in 2010 is 3,540 rubles. per 1000 m3 of gas

Specific and annual fuel consumption is given below in Table 2.

Table 2. Fuel consumption.

Depreciation component of production costs

The percentage of depreciation charges was determined using the straight-line method, taking into account the service life of the main equipment. Annual depreciation charges amount to 24.691 million rubles. in year.

Wage. Salary deductions

The number of industrial production personnel is 36 people.

The average salary in 2010 was 19,000 rubles per person. per month.

Contributions for social needs are accepted in accordance with current legislation:

Direct insurance payments to the Pension Fund, Compulsory Medical Insurance Fund and Social Insurance Fund - 34% of the wage fund.

Total wage costs, taking into account direct insurance payments to the Pension Fund, Compulsory Medical Insurance Fund and Social Insurance Fund, will amount to 9.9 million rubles.

Repair costs

The cost of repairs of main and auxiliary equipment is carried out once a year, within 15 days of each of the individual units of thermal power plants together with peak boilers, amounts to an annual amount of 84.717 million rubles.

The total annual production costs in 2011 (start of operation) are shown below in Table 3.

Table 3

Total annual production costs (million rubles)

5.Calculation of investment efficiency

Commercial (financial) efficiency was determined at a discount rate of 9%.

Calculations of investment efficiency were carried out for the financing scheme described in paragraph “Sources of Financing”.

The duration of the calculation period is assumed to be 5 years. The calculation step is 1 year.

When calculating the efficiency indicators, we took into account those predicted in accordance with the “Scenario conditions for the socio-economic development of the country for 2011 and for the period up to 2015”, approved by the Government of the Russian Federation in March 2009. The forecast values for the price growth rates are indicated below in Table 4 .

Table 4 - Forecast of growth rates in prices for electricity and heat for 2009-2015.

Estimated zonal tariff for electrical energy in 2010: 2.6 rubles/kWh, tariff for heat -0.896 rubles/kWh. The tariff is adjusted taking into account changes in price indices for these types of energy.

Tax rates are adopted in accordance with current legislation and are:

- value added (VAT) - 18%;

- for property - 2.2% of the residual value of fixed assets;

- on profit - 20%.

Table 5.

Financial and economic indicators of the project

|

Name |

||||||||||

|

Capital costs for the project / loan for construction and commissioning of the station |

||||||||||

|

Production and sale of electricity and heat under the project |

kw.hour electric energy |

|||||||||

|

hour warm |

||||||||||

|

Operating costs |

||||||||||

|

Fuel gas costs |

||||||||||

|

Total costs |

||||||||||

|

Revenue from the sale of electricity and heat |

||||||||||

|

Payment of interest on the loan |

||||||||||

|

Paying off the loan body |

||||||||||

|

Net income |

||||||||||

|

Accumulated net income |

||||||||||

|

Loan repayment period |

||||||||||

The project's economic efficiency indicators are shown in Table 6.

Table 6. Indicators of economic efficiency of the project

These indicators demonstrate a high degree of investment efficiency.

6. Conclusion

The project concerns the pressing problems of the further development of the Russian small-scale industry - the provision of energy resources for the local market.

The project also has important humanitarian and social significance - it creates, directly and indirectly, new jobs at the station and in enterprises consuming energy resources.

In addition, the presence of a thermal power plant in the region will attract investors to other projects in the region, since investors will be confident in the energy supply of the projects.

The annual average Net profit during the implementation of the Project (five project years) is about 80 million rubles. It should be noted that during the first four years after the launch of the station, the loan received is fully repaid. During the first year AFTER compensation of the loan, the net profit on the project will be 486.403 million rubles.

So, the annual net profit confirms its high efficiency.

An important stage in the implementation of a business project is the calculation of the ratio of risks and planned profitability. In economics, there are methods for such calculations that allow you to determine the feasibility of investing money in a project.

For a new business project being developed, it is necessary both for the owners themselves and for raising funds from (banks, investment companies, private investors). The business plan includes a feasibility study (hereinafter referred to as feasibility study). In existing businesses, feasibility studies are also used when modernizing production or introducing a new direction.

A feasibility study is an official document that contains feasibility studies that help determine the degree of feasibility of implementing the intended business project.

It provides calculation and analysis of economic indicators, selects options for the most effective economic and technical solutions, and proposes organizational methods for their implementation at the enterprise.

Purpose and main objectives of the document. Rules for its use

The main purpose of a feasibility study is to demonstrate the income from investing in the implementation of a new project or the modernization of an existing business.

Drawing up a feasibility study allows you to analyze the external and internal factors that will affect the project during its existence. In practice, a feasibility study is compiled as a document when submitting an application for bank lending.

A feasibility study may contain several options for the development of events during the implementation of the project, and, therefore, managers can clearly see the effect of investing money.

A feasibility study may contain several options for the development of events during the implementation of the project, and, therefore, managers can clearly see the effect of investing money.

Feasibility study allows enterprise managers to decide the following tasks:

- Choosing a more effective project;

- Attracting additional sources of financing for the investment project;

- Increased productivity (if the feasibility study is compiled for an existing business), and as a result, increased profitability.

Structure and content

The structure of the feasibility study of an investment project does not imply strictly established content. The sections that will be included in the feasibility study will depend on the scale of the intended project, the specific goals of the project, the desires of managers, or the requirements of lenders or investors. Thus, the structure and content of the technical and economic content are advisory in nature; we highlight those sections that can be included in the feasibility study.

If you have not yet registered an organization, then easiest way This can be done using online services that will help you generate all the necessary documents for free: If you already have an organization and you are thinking about how to simplify and automate accounting and reporting, then the following online services will come to the rescue and will completely replace an accountant at your enterprise and will save a lot of money and time. All reporting is generated automatically, signed electronically and sent automatically online. It is ideal for individual entrepreneurs or LLCs on the simplified tax system, UTII, PSN, TS, OSNO.

Everything happens in a few clicks, without queues and stress. Try it and you will be surprised how easy it has become!

Summary

It indicates the name, participants, goals, total cost, sources of raising funds, main indicators of the financial feasibility of the investment project. This part is key, as it outlines the main essence of the project. The information presented in the resume should be presented briefly and concisely.

A detailed explanation of the presented points is given in subsequent sections of the feasibility study.

Description of the enterprise's activities

This paragraph indicates: the industry, the principles of the management structure, the prospects for this area in the market. Possible or existing partnerships are listed.

Description of the project idea

This section highlights the relevance and innovativeness of the implementation of this project, and the problems that its implementation will solve.

If the project proposes the production of a specific product, then its characteristics are highlighted: name, areas of application, competitiveness in the market. Information about environmental friendliness and the possibility of its disposal after use may also be indicated.

The production program is provided, which indicates:

- volume of product output;

- cost with justification;

- market for the produced goods.

Financial component of the project implementation

This part of the feasibility study provides a description of the sources of funds raised, indicates creditors or investors (if any), stages of use and repayment of the money received.

Such information is presented in the form of calculations of economic coefficients.

Economic effect from implementation

The final section provides information about the project, the number of jobs created and other data.

Rules and step-by-step registration instructions

Despite the fact that a feasibility study is compiled for each project individually and there are no uniform rules for its preparation, experts still recommend adhering to certain recommendations. This will make it easier for beginners in this area and will not allow them to deviate from the main task - to fully reflect the feasibility of the project.

Let us present a number of recommended step-by-step actions when registering Feasibility study:

Let us present a number of recommended step-by-step actions when registering Feasibility study:

- disclose the main characteristics and achievements of the enterprise (if there is an existing one), information about the managers, present the idea of the project;

- characterize the industry, its current state, development prospects in general in the country and in a particular region. This may be the demand for the product that will be brought to market as part of the project, an analysis of the activities of competitors and the characteristics of their products;

- highlight data on costs and income when implementing a feasibility study. It is important to divide costs into temporary and permanent ones, and calculate income at different levels of demand;

- give a general assessment of the project implementation. To do this, a cash flow plan and a forecast balance sheet are drawn up, which also contains Form No. 1.

Mandatory data that must be indicated in the feasibility study

A feasibility study is compiled for various industry areas of business, and therefore its sections can be replaced or added.

But unchanged points in the feasibility study are:

- Description of the project, its role in the development of the enterprise, the impact on the economy as a whole of the country or a particular region may also be indicated;

- Analysis of market conditions;

- Labor cost analysis;

- Financial analysis of a new project;

- Payback period planning;

- Conducting an economic assessment of an investment project.

Distinctive features of the document

In order to understand the distinctive features of a feasibility study from a business plan, it is necessary to introduce their concept.

A business plan is a document that characterizes the implementation of a business project from all aspects of business activity.

A business plan is a document that characterizes the implementation of a business project from all aspects of business activity.

The feasibility study is description of the project implementation from the perspective of economic indicators and characteristics of the necessary equipment to start the project.

A business plan is a more comprehensive presentation of material about the project and contains a lot of theoretical information. A feasibility study more clearly shows the effectiveness of an investment. Thus, the business plan includes a feasibility study.

Let us more clearly present the main parameters that distinguish a feasibility study from a business plan in the table.

| Comparison parameter | Feasibility study | Business plan |

|---|---|---|

| Purposes of compilation | Justification of the profitability and effectiveness of the project only from the economic and technical side | Assessment of all factors influencing the project |

| Consumers | - management personnel; - shareholders; - partners; - less often banks and investors. | - investment companies; - venture funds; - large banks. |

| Document structure | - general project parameters; - items of expenses and income, ratio analysis; - justification of the need for financial resources. | - project parameters, as well as information about the company and founders; - market analysis, including marketing research; - organizational plan; - the impact of the regulatory framework on the implementation of the project; - risks, including economic ones; - the financial analysis; - calculation of the economic effect from the implementation of the project. |

| Cases in which a document is drawn up | - search for funds for the implementation of new equipment; - launch of a new production line; - other projects related to modernization. | - launch of an innovative project; - startup launch; - raising the full amount necessary for the implementation of the project. |

Features of feasibility studies for various types of projects

The feasibility study is developed, as noted above, for various purposes of the enterprise. In this connection, in theory, several types of feasibility studies for project implementation are distinguished.

Let's present them in more detail.

Feasibility study for an investment project a visual display of the project’s profitability is compiled. Within its framework, products that are often already proven and familiar to the market are sold. The customers of this type are investors.

Feasibility study for an investment project a visual display of the project’s profitability is compiled. Within its framework, products that are often already proven and familiar to the market are sold. The customers of this type are investors.

For an innovative project a more detailed efficiency calculation is required since the product is assumed to be new. There are significantly more risks in such a project. The main consumers of this type of feasibility study are managers.

Feasibility study for a construction project has a more complex structure. It reflects the production capacity and capacity of the capital structure. Research of the real estate market of a particular region is provided, information about the land plot is indicated.

Feasibility study for reconstruction aimed at disclosing information about the need to update the production complex. The emphasis in the structure of this type of document is on finishing work; if necessary, the purchase of new equipment is indicated.

Preparation of a feasibility study during modernization carries the same meaning as during reconstruction, only in this case a justification is given for the replacement or modification of fixed assets: equipment, machinery, and others.

Feasibility study for an agricultural project contains in its structure options for using existing land plots, farming methods, models for using the resulting products (further processing, sale).

About feasibility studies for geological projects, see the following video:

Company managers responsible for business development are at the project initiation stage. They need to prepare him for an effective start. First of all, this requires recognition of the need for investment. Even before reaching potential investors, this is achieved through a sequence of prepared events from the presentation of the project to its customer to the defense of the business plan. In this series, a special place is occupied by the feasibility study of proposed investments.

Location of feasibility study

Depending on the established tradition, either the development director or the technical director is responsible for the preparation and presentation of the feasibility study, and sometimes a future curator is involved in this task. Let us immediately distinguish ourselves from such a form as a feasibility study for construction, which is a section of design and estimate documentation. In this article we consider the universal aspect of EFT as a stage of the initiation stage, which, in turn, consists of three parts.

- Making a decision to implement the project.

- Definition of the design task as a control object.

- Organizational support for the launch.

The first part of the initiation begins with the formulation and presentation of an initiative proposal for the project to the customer. Perhaps the investment initiative arose at a strategic planning session and was included in the strategic action plan long before the start. In any case, such a presentation is entrusted to the initiator of the idea.

Next, he develops a project concept, on the basis of which he is given instructions to prepare a feasibility study. The financial and economic section of the document is prepared by financial departments, and the development of a feasibility study in its technical part relates to the production and technical services of the enterprise management.

Project initiation stages

The concept and feasibility study are included in the business plan as its sections. The first part of the initiation ends with a decision on the implementation of the project by the top management of the company, the customer. After the decision to launch, a curator is appointed by a separate order. To better understand the subject, we should distinguish a feasibility study from an investment memorandum and from a business plan as such.

The fact is that the feasibility study of an investment project serves the internal purposes of the company, while the investment memorandum is a document for external use. An enterprise does not always have sufficient funds of its own for investment; its management enters the market in search of investors who are ready to consider the potential of the project in their own interests. The investment memorandum is focused on the values of investors and aims to attract them.

A good business plan is a true work of business art. The rationale in it for the marketing, technical, financial, economic and personnel aspects of the upcoming investment project is deep and extensive. At the same time, the feasibility study reflects information and arguments in favor of executing the project, based on aggregated calculations in the economic and technical areas of its key business idea.

Structure of the feasibility study

The structure of the feasibility study is formed taking into account the scale of the project. There is no doubt that the need for a detailed feasibility study does not always arise. To do this, the level of the project and the degree of its uniqueness must indicate the high labor intensity of design research, multifactorial implementation and the economic complexity of obtaining financial results. The detailed feasibility study in the universal version has the following sections.

- General information about the company's activities. Historical background, types of activities, position in the market, technological equipment (uniqueness and modernity of equipment), etc.

- Brief analysis of the market and target audience of product consumers.

- Issues of interaction with the immediate and distant environment of the investment object (territorial location of the object, social significance, interaction with society, authorities on environmental issues, tax revenues, social security).

- The essence of the technical and technological idea of the project. Describes how technical problems are expected to be solved and the benefits of their results.

- Description of the organizational and production structures of the company and issues of integration of the investment object into them.

- A summary of the requirements for project resources: financial, labor and material.

- Integrated calculations of production and total cost per unit of product based on the results of the project.

- Calculation of profitability and profitability of the project and production of products at the investment site.

- Final calculations on investment efficiency (NPV, IRR, payback period, etc.).

- Rough analysis of the project's expected risks.

- Primary environmental analysis of proposed investments.

- Conclusion with justification of conclusions about the attractiveness of the project from market and financial-economic positions. Implementation recommendations.

The proportion of projects with a detailed business plan is small in many companies. Feasibility studies are used much more often, especially in cases where there are no plans to attract external investors for investment. The economic return of the investments made largely depends on how well the justification is carried out. Therefore, as a conclusion, I would like to emphasize that the customer, supervisor and PM should always remember this stage of justification. A well-founded decision can remove up to half of the possible risks and improve the quality of project activities as a whole.

A feasibility study is made if you need to prove why it is necessary to purchase any equipment, choose certain technologies, follow a certain path of enterprise development, and calculate what benefits this will bring.

Feasibility study: what is it?

A feasibility study (TES) means a documentary substantiation of the feasibility of a particular project. This document should contain an analysis of the required investments and the expected result.

A feasibility study shows the profitability of the project and whether it is worth investing in it.

Thanks to him, certain problems are solved:

- attracting additional finance;

- selection of the most cost-effective project;

- increasing the productivity of the enterprise;

- improving the financial position of the enterprise.

Feasibility study and business plan: what are the differences

A business plan and a feasibility study are similar. They differ only in that a feasibility study justifies a project at an existing enterprise, and a business plan shows why this company should exist.

Therefore, such areas as marketing research, market analysis, description of the organization itself and manufactured products are not taken into account when compiling it. A feasibility study is, unlike a business plan, a shorter but quite informative document.

When drawing up a feasibility study, they usually rely on:

- on the features of the technological process;

- on what requirements are set for production equipment, equipment, communications;

- on employees and work process costs;

- on what the free price for products is;

- on the time frame in which the project is planned to be completed;

- on economic results;

- on environmental factors.

In what cases is a feasibility study of the project, goals and objectives needed?

Life is full of a wide variety of situations, different tasks arise, and the degree of their importance also varies. The essence of a feasibility study is to calculate possible or expected changes. The costs required to complete the projects are also taken into account.

A feasibility study is the answer to the question of whether a given project is worth the expected costs.

Thus, a feasibility study is necessary in order to assess the situation in the organization after making qualitative or quantitative changes in its work. When compiling it, a wide variety of factors are taken into account that directly or indirectly affect the organization and how much its financial performance has changed.

If this document is drawn up correctly, the effectiveness of investing in new developments and in refining existing types of activities is visible, whether any other changes or subsidies are needed, and perhaps lending is needed. A feasibility study is necessary if you need to select new equipment, make a choice of technologies for the organization and then implement them in life, and decide on the organization of the enterprise’s work.

Drawing up a feasibility study is necessary for both the head of the enterprise and its investor. The first - to understand whether the expectations placed on the project will live up to, the second - to understand when the invested funds will pay off.

A feasibility study can be developed by either the businessman himself or a group of specialists if the project is complex.

Learn how to prepare a feasibility study for a business project from the video.

Structure and process of preparing a feasibility study

The concept of feasibility study in the business world is one of the most frequently used and used. There is an approximate structure from which you can deviate, depending on the specifics of the project.

It can either narrow or expand, depending on the complexity of the planned changes.

Typically, the document describes the direction in which the company operates, and also justifies the choice of business location, the type of products produced, and justification for their cost. Among the mandatory items is the financial part of the project.

This should indicate the sources of financing, when and how the debt will be repaid.

When compiling a feasibility study, as a rule, the following thematic sections are included:

- initial indicators, data on the business sector;

- business opportunities today;

- raw materials used, financial opportunities for enterprise development;

- estimated costs for the enterprise to achieve its goals;

- operating costs necessary to implement the project;

- proposed development plan;

- financial goals of the enterprise;

- general data of the future project, its effectiveness and payback, conclusions.

The feasibility study must contain tables with data on the movement of material assets and their balance.

Timeframe for preparing a feasibility study

The time frame for preparing a feasibility study is related to:

- with detailed description;

- with the volume that is planned to be developed;

- with the number of processes that will be considered;

- whether the material has been prepared, how relevant these regulations and other company documentation are;

- with whether the necessary personnel are available;

- with whether the infrastructure is ready.

On average, preparing a feasibility study takes from one month to a year, depending on the complexity of the project.

Example of a feasibility study for a project

If the sequence of work on the business plan and its structure are clearly stated, then when drawing up a feasibility study, such requirements are not put forward. Depending on the problems that are being considered and will be solved, feasibility study options may differ.

Example one:

- The current state of the company.

- Analysis of the organization's business and production capacity.

- Technical documentation.

- State of labor resources.

- Company overhead and organizational expenses.

- Project duration analysis.

- Assessment of the material and economic attractiveness of the project.

Example two:

- What is the project: its essence, foundations and principles of implementation.

- A brief description of the business, highlighting the results of various studies for a better understanding of the demand for a newly introduced service or product.

- Engineering and technological component of the project: work process (description);

justification of the need to purchase new equipment and improve existing equipment;

how the new product fits into currently applicable standards;

analysis of a new product, its pros and cons.

- Economic and financial indicators:

required and expected investments;

sources of funds, both internal and external;

estimated production costs.

- Analysis of the effectiveness and profit of the project, guaranteed repayment of external loans.

- Assessing the susceptibility of a new product to risks known in business, and resistance to similar crises in the future.

- Analysis of the effectiveness of external investment.

Example three:

- Announcement of all main provisions of the feasibility study.

- Under what conditions is it possible to implement these plans (the author of all the main plans, where the source material was taken from, a description of the preparatory stages and research).

- Description of potential sales markets, assessment of the enterprise's capabilities, calculation of the company's strongest points, a variety of factors.

- Ensuring production (available resources and planned reserves), assessing the capabilities of competitors, possible suppliers, possible costs.

- Geographical location of the company and associated costs.

Calculation of estimated rental payment. - Documentation (project, design work).

Analysis of the necessary auxiliary facilities, without which it is impossible to carry out all planned activities. - Human factor: how many employees are needed, and what positions, to implement the project.

The number of employees, engineers and other specialists is calculated. It is also important to indicate how many local or non-resident (foreign) specialists will work at the planned enterprise.

It is necessary to calculate the company's expenses for the salaries of these employees, taxes, pension and other fees. - When is the planned project scheduled to begin?

- Material and economic assessment of the benefits of this project.

Most of these feasibility study examples can be compared to a carefully crafted business plan. The line that exists between a feasibility study and a business plan is thin enough to argue that these are completely different things.

Feasibility study of a loan: example

When applying for a loan for the development of an enterprise, you cannot do without this document. A feasibility study is a demonstration of the seriousness of the borrower’s intentions.

Here he proves that the company needs credit funds and what it intends to spend them on, and most importantly, that it can return them. This document can be executed in any form, the main thing is to prove to creditors that the money will go to the right things and this investment will pay for itself over time, thanks to which the borrower will be able to repay bank funds with interest.

On average, the volume of a feasibility study prepared for a report to a bank is several pages, sometimes more.

Whether the owner of the enterprise will receive credit funds depends on how well and competently the feasibility study of the loan is completed. This document must indicate all the nuances and reasons why the credit institution should issue a loan.

This document must set out facts confirming the return on investment of the planned project. This document is of equal importance for both the applicant and the financial structure.

When applying for a loan, a potential borrower draws up a feasibility study, the purpose of which is:

- prove to the credit institution that the company needs these funds and that the company will be able to repay this loan;

- provide economic and technical evidence of the feasibility of the project.

In order for the bank to agree to a loan agreement, the document must reflect the effectiveness of the economic plan and the ability to recoup costs during the loan period.

An approximate example of a feasibility study compiled for taking out a loan looks like this:

- control dates of the contract;

- funds that the company currently has in use;

- taking into account currency fluctuations at the time of conclusion of the contract;

- the price of the entire transaction (for contracts with foreign partners, all excise and customs duties must be taken into account);

- estimated profit from the project;

- taking into account possible costs;

- movement of funds;

- tax on estimated profits.

The actual amount of money that will remain with the client after repaying the loan and all taxes. Calculation of the profitability ratio and profit from this transaction.

For example, one company wants to take out a loan in the amount of 50 million rubles. at 15 percent per year for 3 months for the purchase of any product, for example, perfumes. A guarantee agreement has been concluded with an insurance company.

The organization wants to carry out these actions without using its own funds and the money of investors. It is planned to receive a profit monthly, from which the loan debt will be repaid. Some funds will remain for the company.

After evaluating this feasibility study, specialists from the banking structure will immediately determine the low profitability of this project.

They will conclude that the company will be able to repay the loan on time with a threefold turnover.

Moreover, taking into account all tax payments, the profit will be even less. Turnover in this situation is only possible with established connections with partners.

We can conclude that without involving one’s own funds in the turnover of this project, the future transaction cannot be considered profitable.

Most likely, the bank will not take risks and the company will not receive a loan under such conditions.

Learn how to draw up a business plan and feasibility study from the video.

An economic justification is a document that sets out the profitability, analysis, calculation of indicators and effectiveness of an investment project. The purpose of the project may be the acquisition of machinery, equipment, construction or reconstruction of an industrial building, etc.

Instructions

The main goal of the economic justification is to convey to the investor the amount of costs for the project, its payback period and the results of the work. The difference between this document and a business plan is that it is drawn up for new products of an existing enterprise, therefore issues related to market analysis and marketing research are not set out in it. The business case usually contains a detailed description of the technologies and equipment, as well as the reasons for their selection.

When drawing up a business case, a certain sequence must be followed. It starts with initial data, information about the market sector. Then the existing opportunities for business development, sources of raw materials, material resources for business expansion, the amount of capital expenditure required to achieve the goal, production plan, financial policy, and general information about the project are described.

Thus, the economic justification contains a description of the industry in which the enterprise operates, the type of products supplied, and the price level for it. The financial part of this document includes the conditions for attracting borrowed funds and sources of their coverage. Calculations are presented in tables that reflect the movement of cash flows.

When drawing up an economic feasibility study, it is necessary to study the current position of the enterprise, its place in the market, the technologies and equipment used. In addition, it is necessary to determine ways to increase the profitability of the company and business development, predict the level of profitability that can be achieved when implementing the project, study the necessary technical data, and analyze the level of staff training. You will also need to draw up a project implementation plan, cost estimate and cash flow plan, as well as give a general economic assessment of the investment.

Justification stage project very important. During it, you can identify and, if possible, correct those moments that could lead to failure in the future. Focus on starting early and you will achieve better results.

Instructions

Define the goals and objectives of the justification project. You need to answer the main question: is the project necessary? Based on how well you develop the idea and convey the benefits that the new business can bring, a decision will be made whether to accept or not project.

Describe the essence project. Tell us what exactly you plan to do and what goals are being pursued. Explain how the need for a new business arose and why this particular path was chosen.

Convey to the reader or listener the main ideas and ways in which the result will be achieved. Convince him that the chosen methods are the most effective in this case.

Tell us how many employees will be needed to implement your project, and what qualifications they should have. Give reasons why the workforce should be exactly like this. Describe in detail the functions of each team member. If you already have candidates, voice their names. In addition, committee members or your management should know how participation in the project will affect the core work of these employees.

Establish a sequence of actions and announce deadlines project. Clearly list the main stages of its implementation. Then go into detail about each stage. There should be a visible logical relationship between actions so that it is clear why one point follows another. Talk about realistic deadlines; if this is problematic, do not just name the minimum possible completion date project, it is better to indicate the maximum period. Explain what factors may affect task completion time.

Provide a calculation of the material resources that will be involved in the project. Show what each expense item consists of. Before the presentation, count everything again. Remember that if you make inaccurate calculations or leave out an important item, it may blur the impact of the rest of your case and result in your rejection. project.

How to write a business case

A business case is also called a financial economic assessment, which is a form of impact assessment. It is used to assess changes in all net cash flows that arise as a result of the implementation of government regulation methods, the establishment of regulatory legal documentation, and corporate programs that are aimed at changes in the economic and social structure.

Instructions

Introduce changes to technical regulation standards, as well as change industry norms, introduce various technical regulations. This will help you change and redistribute the benefits, costs, and risks of the enterprise.

Predict changes in all existing factors (benefits, costs) at the design stage of changing technical regulation standards. Assess the financial and economic results of compliance with these standards, ensure optimization of costs for compliance with the standards.

Adjust the direction of the standard development process and ensure that the impact of all standards being developed is modeled on the state of the enterprise and its industries. Create a plan to more effectively interact requirements across different levels of the technical regulatory structure.

Feasibility studies of investment projects, depending on the sector of activity and the scale of the tasks, have a variety of applications. For example, in construction, this document not only serves as a justification for making a fateful decision, but is also one of the key documents allowing the construction of a facility. In this article we will briefly look at several examples of feasibility studies of design solutions in construction and other sectors of the economy.

Feasibility study in construction

Enterprises in the construction industry belong to the so-called project production. Each contract is implemented in project form. In other words, contract projects are used in construction, which differ from typical business development tasks in the portfolio planning mode and resource optimization. The preparation of a feasibility study is carried out by working out a number of issues:

- technological;

- space-planning;

- constructive;

- environmental protection;

- environmental safety;

- sanitary and epidemiological;

- operational safety;

- economic efficiency;

- social consequences.

Regulatory acts establish the procedure for coordination and approval of feasibility studies by executive and supervisory authorities. After these procedures, the feasibility study of the investment project being developed is accepted as the basis for the tender package of documents and bidding. A contract is concluded and detailed design begins. The following is an example of the structure of a feasibility study for a residential building construction project.

An example of the structure of a feasibility study for the construction of a residential building

There are specialized design organizations on the market, or the construction companies themselves have a staff of specialists who carry out the development of feasibility studies. Quite often, the customer holds a competition between potential contractors to select a design proposal. The designer acts on the basis of a signed contract for the feasibility study. In the feasibility study of an investment project, the financial model of cash flows and calculation of investment efficiency are essential. A diagram of the investment model of Cash Flow dynamics and self-sufficiency is presented below.

Scheme of the investment model of Cash Flow dynamics and self-sufficiency

In the presented scheme, the calculation of the final Cash Flow is used to construct the graph. In any investment event, the first stage is characterized by a negative cash flow balance. Then, as the financial result is formed, the project itself pays off, and then the newly released product. In the procedure for a feasibility study of a decision to implement an investment project, the main calculation part consists of the following components.

- Production program of the investment facility.

- Investment plan.

- Enlarged cash flow plan.

- Enlarged plan of income and expenses.

- Set of project performance indicators.

Examples of justifications with calculations

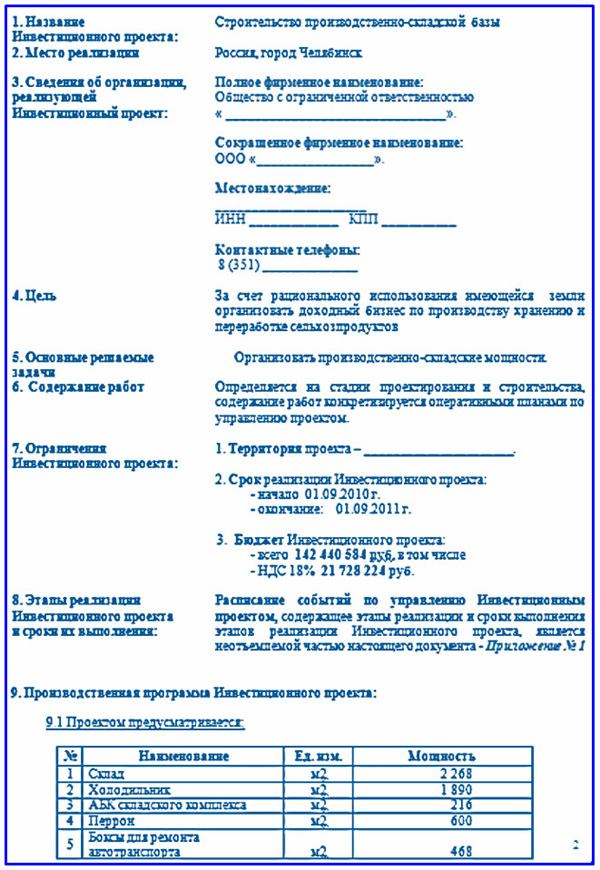

We will consider a simplified version of the feasibility study for considering an investment project using the example of the construction of a production and warehouse base. Let’s assume that a company owns land with an area of N hectares and intends to evaluate the possibilities of designing and building a base for processing and storing fruits and vegetables. A special feature of this feasibility study was the reduced composition of its sections, since it was not planned to attract a third-party investor, justification was required only for internal purposes.

Example of a preamble to a feasibility study and part of a production program

The document does not include a project summary. It also does not contain an overview of the regional warehouse real estate market. The investment cost plan has not been deployed. The list of abbreviations can be continued, however, the justification succinctly sets out all the main aspects sufficient to make a decision on the project and begin its planning. The missing sections must be included in the business plan, if only because the amount of investment exceeds 100 million rubles. This example does not present the financial and economic part due to its volume.

Continuation of the example of a feasibility study for the construction of a production and warehouse base

The following calculation of a preliminary feasibility study is taken from the private dentistry industry, the most dynamic area of Russian business. Let's consider an example of a small project for the purchase of a set of dental equipment, which allows the introduction of several high-margin services. We present to your attention a part of the financial and economic block, including a cash flow plan and payback calculation. At the same time, in order to simplify the registration, the cash flow plan is combined with the income and expense plan. This is quite acceptable within the framework of a preliminary feasibility study. At this level, the tax burden and other overhead costs can be taken into account schematically.

An example of a feasibility study for a local project in the dental business

A PM looking for professionalism needs to know a lot. The range of his interests goes far beyond the scope of direct project implementation. The manager must understand how the project is initiated, what documents accompany this process and how to prepare them efficiently. The feasibility study, its development, calculation and presentation constitute an important part of the required RM competencies. Visual images of the feasibility study examples shown in this article will help the project manager more easily navigate investment business development programs.