Job description for combined accountant and HR officer. Accountant. Model job description. Download sample text. Effective combination of functions: job description of a human resources accountant

Often in enterprises there is a situation where the functions of an accountant and a human resources manager closely overlap.

Often the relationship between these departments depends on total number of employees and number of staff units one or another unit of the organization.

Moreover, figuring out whether a particular issue is within the competence of a personnel officer or an accountant is not always easy.

At the same time, artificially separate the HR and accounting services inappropriate.

Sometimes this can lead to the loss of important documentation and errors in reporting.

In such a situation it can help well designed instructions for a human resources accountant, which very clearly formulate responsibilities of this staff unit.

In what cases is it prescribed?

The staffing position of an accountant-HR officer is most often introduced in small enterprises with a small number of employees personnel, where it is possible to effectively combine functions within one structural unit.

What skills should a HR accountant have?

An HR accountant must be confident in using software 1C, “Salaries and Personnel”, have the skills to prepare financial statements, payroll, maintain paperwork (advance reports, maintain inventory sheets, carry out budgetary and extra-budgetary accounting).

Also He must possess the skills of re-registration of an enterprise, be able to carry out reconciliations with the tax office, clients and suppliers.

From a HR accountant formatting skills required work books, keep records of them, draw up liability agreements, keep registration logs, carry out personalized accounting. He must know basics of interaction with the Federal Migration Service, employment service, Pension Fund.

Sample job description for an accountant with the functions of a personnel officer.

General provisions

The HR accountant is entrusted with combination of functions for the production of personnel document flow and accounting of employee salaries with reporting. This position provides documentation development in the field of personnel accounting and movement, working time recording and payroll calculation.

Pretend to filling this vacancy can be a specialist with a higher education in economics and 3 years of work experience in the specialty. Only the supervisor.

The HR accountant must have a good understanding of legislative acts, on the basis of which accounting is regulated.

He will also need knowledge labor law. He must be competent in such branches of law as civil, financial, tax law.

Gotta figure it out in the peculiarities of the organizational structure of this enterprise, know the staffing table, the specifics of economic activity. From a HR accountant deep knowledge required in the field of document management, methods of economic analysis of labor and wages, knowledge of the taxation procedure for employees.

Rights of a human resources accountant

The HR accountant has the right:

- To receive information about those preparing for implementation management project proposals that relate to the performance of his duties.

- Contact management with initiatives to increasing efficiency of its activities.

- Make a request from departments of the organization information and documents necessary for work.

- Contact management with a request for assistance.

- Put signature on documentation within the limits of their authority.

Responsibilities of a personnel officer

The following points relate to the responsibilities of a personnel officer:

- Prepares time sheets, records and analyzes working time.

- Prepares temporary sick leave sheets, care certificates and other documentation that indicates good reason for absence personnel to work.

- Performs payroll calculations.

- Handles registration postings.

- Implements social contributions with PHOT.

- Contributes funds to the fund financial incentives personnel.

- Prepares periodic reporting on the unified social tax.

- Prepares accounting documentation before handing it over to the archive.

- Monitors settlements with accountable persons.

- Prepares information for balance information.

- Engaged in conducting personnel documentation.

- Hires and fires employees. Responsible for arranging vacations and changing salaries.

- Maintains staffing table, registration and accounting work records, leads Personal things workers.

- Engaged in concluding employment contracts and liability agreements.

- Maintains log books, deals with archiving.

- Issuing certificates and copies of documents to employees of the organization.

- Works on statistics personnel accounting and movement.

Responsibility

The HR accountant is responsible for:

- Improper execution, and non-performance their functions.

- For committing illegal actions when performing official functions.

- For causing the organization material damage.

- Behind inadequate provision compliance by staff with labor discipline.

Interaction within the company

The HR accountant carries out intra-company interaction:

1. With the head of the enterprise or another person temporarily performing his duties:

- on issues of receiving orders, instructions, instructions related to his official activities;

- obtaining information necessary to perform their functions.

2. With the Chief Accountant with the aim of:

- receiving orders, instructions regarding the preparation of reporting documentation, regulatory documents;

- in order to provide information necessary to perform the duties of a human resources accountant.

3. With accounting employees with the aim of:

- obtaining documents necessary for the HR accountant to perform official functions;

- provision of incoming documentation and other information related to the activities of a human resources accountant.

4. With other employees organizations for the purpose of:

- obtaining the documentation necessary to implement the official functions of a personnel accountant;

- providing correspondence originating from the structural divisions of the organization.

Thus, the HR accountant combines mainly the functions HR manager and payroll accountant.

That is, his responsibilities include contact employees regarding solving current problems related to hiring, going on vacation, pension contributions, etc. At the same time, the HR accountant is also assigned functions related to accounting and financial reporting in the field of labor and wages.

In a small business environment this is creates certain conveniences both management and the employees themselves. For example, wages are a category that in large organizations is the responsibility of both accounting and personnel departments.

On a number of issues related to wages, the employee is forced to contact the accounting department first, and then the HR department, since there is a strict distribution of powers between them.

If you have the position of a human resources accountant, this is no longer necessary.

A number of other examples can be cited that prove feasibility of introducing a staff unit HR accountant for small businesses.

Have you decided to open your own business and have already thought about the staff?

Then you a specialist will definitely be needed, which will pay your employees wages.

In enterprises, this is usually done by a payroll accountant. It is necessary both for settlements with the public (buyers), and with counterparties, and suppliers.

A payroll accountant primarily calculates payroll and social benefits, due to employees at the expense of the employer.

In his work he relies on legal norms labor and tax codes of the Russian Federation. All functions of an accountant are described in detail in the job description, which the employee signs along with the employment contract upon hiring.

How to choose a frame?

From professionalism The financial condition of the organization and the general mood in the team depend on the accounting accountant. Therefore it is important to find sensible accountant. You can search for a suitable employee on one's own by posting a vacancy announcement in the media, or you can ask for help at recruitment agency. In any case, when selecting an accountant, there are several points to consider.

Search time

Invite an accountant in the accounting department to work the best thing after submitting quarterly, semi-annual or annual reports, as well as at the beginning of the month, when wages for the past month has already been accrued.

During this period, the workload of accountants decreases, and they themselves begin to look for more promising job without harming your current company.

By the period in which a candidate changes jobs, one can judge his professional responsibility.

Education

experience in a similar position and professional competence For a good accounting accountant, more is important than the level of education.

However, specialists with specialized higher education: accounting and auditing, finance, economics. Applicants with a technical background are also suitable.

Skills and knowledge

Applicant for the position of accountant must:

- know basics of accounting and tax systems;

- be literate PC user;

- own basic office and accounting programs (for example, 1C: Accounting);

- be able to work with the bank-client system, electronic tax reporting system and legal programs;

- have skills business correspondence.

Estimate professional level The specialist will be helped by an interview and a test, including questions on the specifics of settlement activities.

Seniority and work experience

Average length of service The work of a competent accountant in one place cannot be less than 2-3 years.

Preference should be given to the candidate who has worked at the enterprise, similar in field of activity your organization.

Personal qualities

You can feel free to hire a responsible, scrupulous and accurate accountant with analytical thinking and a balanced character. They will help you evaluate such qualities of the applicant case assignments.

Basic requirements for the specialty

For the position of accountant of the settlement desk, as a rule, accepted:

- specialist with average professional(economic) education without requirements for work experience;

- specialist with completed higher professional(economic) education, who has undergone special training according to the established program, with at least 3 years of experience in accounting and control.

Accountant of the settlement desk belongs to the category specialists, management personnel. Reports directly to the chief accountant.

Intelligence

What should I include in the instructions? General provisions, duties, rights, responsibilities, qualification requirements, required knowledge and interaction between employees must be clearly stated in the job description. This document must carefully describe and model all labor processes.

The job description of a settlement group accountant must be drawn up based on legislative framework. It is necessary to take into account the specifics of the enterprise’s activities and the amount of work that the accountant must perform.

It should be remembered that under no circumstances conditions cannot be worsened the work of a settlement accountant in comparison with the current labor legislation of the Russian Federation.

Sample job description for a payroll accountant.

Roles and Responsibilities

Desk accountant should be able to maintain proper accounting records of property and business transactions, figure it out in the order of conducting documentary checks and audits.

He always should be aware legislative acts and regulations related to accounting.

Know the order document flow, registration and reflection on accounting accounts of operations on the movement of fixed assets, inventory and cash, plan and correspondence of accounts, labor legislation, rules and regulations of labor protection. Be able to use computer technology.

IN responsibilities accounting accountant:

- conducting accounting and tax accounting;

- keeping time sheets working hours;

- payroll, social benefits and other payments in the manner prescribed by law and entering this data into computer systems (salaries, financial assistance, bonuses, etc.);

- issuance to employees of the enterprise, certificates of payroll and other payments, as well as deductions from them;

- treatment primary documents for the relevant areas of accounting (temporary disability certificates, bonuses);

- tax calculation;

- preparation of payroll and tax reports;

- calculation and submission to the relevant funds insurance premiums;

- reconciliation on taxes and fees with the tax office;

- notification of the chief accountant about all identified deficiencies within the limits of its competence.

When is it needed in an enterprise?

If the enterprise is small, is engaged in a narrow specialization, consumables make up a small list, then having a materialist in such a company is of no use - an accountant will handle all matters in one person.

It’s another matter when an organization has several sites that use the same materials, structures, products with an extensive range, a separate unit in accounting is required, so that all this stuff can be tracked in the dynamics of events and dates.

Essential job description

This document is widely used by various organizations. It strictly establishes the key points in the scope of work of the corresponding position.

The type of instruction under consideration is a guideline in the following cases:

- when determining the qualifications of candidates for a certain position;

- when working out the functions of the corresponding work unit;

- when formulating the rights, duties and responsibilities of a specific position.

The design, approval procedure and scope of application of this directive are not regulated by any legal act, including the Labor Code of the Russian Federation. There are only recommendations from Rostrud, which are most often heeded.

How might the absence of this document affect?

Job descriptions are not required, but employers usually have them. This makes it possible to significantly simplify the labor relations between the manager and the staff. They can also prevent adverse consequences. For example, deprivation of an employee’s bonus by management for failure to comply with labor discipline in the absence of appropriate job descriptions can lead to unjustified actions on the part of management. The employee has the right to file a claim in the appropriate court. The outcome of the case will most likely be in favor of the employee.

How is a job description for an accountant developed?

This document can be generated on the basis of a specialized reference book. Most often, enterprises have a directive regarding the duties, rights, responsibilities and qualification requirements for a separate category of personnel, namely specialists.

Accordingly, the job description of an accountant can be developed using the Qualification Directory of Positions and is based on all of the above points. As a rule, the standard document of this directive serves as the basis for the development of specific instructions, which are subsequently supplemented with company-specific aspects.

A clear formulation of the accountant's functions ensures the continuity of the financial service. Specifying the appropriate requirements significantly speeds up the onboarding process for new employees.

A typical example of the considered internal company document

A sample job description for an accountant, which will be discussed below, will give you an idea of its possible form. First, at the top is the title of the document, in bold. The full name of the manager and the name of the company must be indicated.

You should also indicate the date of formation and the serial number of the document. Next is information about the relevant position and structural unit. Usually the first section is devoted to general provisions. These include: hierarchical structure of subordination, reasons for dismissal, rights and responsibilities of a specialist, etc.

Then the requirements for the relevant qualifications are prescribed, more precisely, information about the required level of education, work experience in this position and the availability of related skills. The directive displays a list of internal regulatory documents that regulate the work of an accountant.

The next point is an indication of the responsibilities associated with this position. The rights of the specialist, information about payment and proper working conditions are reflected. At the end there is the signature of the manager and the corresponding date.

Directive on the activities of the chief specialist of the staffing and structural unit overseeing the property and liability aspects of the company

If in a company, usually medium or large, the accounting department is represented by several specialists, then there is a whole list of documents in the area under consideration. Firstly, most often there is a job description for the chief accountant.

Just like in the first document regulating the activities of specialists of this staffing and structural unit, the directive in question has a “header” indicating the full name of the manager, the name of the company and the date. After this data there is usually a space for printing. Of course, there must be a name of the document, immediately after which the date and number are written down again.

The accountant's job description differs from the directive in question in that it contains information about hierarchical subordination. In this case, the chief accountant is directly subordinate to the director. There are also differences in the section that reveals the job responsibilities of this specialist, in particular, he manages, organizes and controls ongoing accounting processes.

The clause regarding rights stipulates the possibility for this specialist to determine the scope of job responsibilities of his subordinates, represent the interests of the company in the course of cooperation with other commercial structures, sign certain documents, etc.

We welcome your comments!

– a document that defines the list of duties, rights and responsibilities of specialists in accounting departments.

I CONFIRM:

CEO

LLC "Supplies Wholesale"

Shirokov/Shirokov I.A./

"12" August 2014

Accountant job description

I. General provisions

1.1. This document regulates the following parameters relating to the activities of an accountant: job functions and tasks, working conditions, rights, powers, responsibilities.

1.2. The hiring and dismissal of an accountant occurs through the issuance by the management of the organization of a corresponding order or instruction and is regulated by the legislation of the Russian Federation in the field of labor.

1.3. The accountant's immediate superior is the chief accountant of the organization.

1.4. During the absence of an accountant from the workplace, his functions are transferred to a person who has the necessary knowledge, skills and competence and is appointed in accordance with the procedure established by internal rules.

1.5. Requirements for an accountant: education of at least secondary specialized education, with work experience of at least two years, or higher professional education with work experience of at least six months.

1.6. The accountant must be familiar with:

- basics of civil and labor legislation of the Russian Federation;

- basics of economics and management;

- internal regulations, labor protection rules; fire safety and other types of security at the enterprise;

- internal regulations, instructions, orders and other documentation directly related to the activities of the accountant;

- organizing the company's accounting workflow;

- templates, samples and forms of various forms and documents accepted in the organization, as well as rules for their preparation, systematization and storage;

- ways and methods of accounting and tax accounting and reporting.

1.7. An accountant must have:

- skills in maintaining and preparing accounting and tax accounting and reporting;

- methods of economic analysis of the organization's work;

- plans and correspondence of accounting accounts.

- skills in working with computers and computing equipment, the Microsoft Office software package, specialized accounting services, as well as all office equipment.

II. Job responsibilities of an accountant

2.1. The duties and responsibilities of an accountant include:

- conducting financial and economic transactions, accounting for liabilities and property, including registration of the acquisition and sale of products, items, inventory, etc.;

- accounting for cash flows, as well as reflecting processes and operations related to the finances of the enterprise on the organization’s accounting accounts;

- working with cash;

- registration, acceptance and issuance, as well as control over the movement of primary accounting documentation (invoices, acts, invoices, etc.);

- working with banks in which the company's current accounts are opened, including submitting payment orders to the bank, requests and receipt of statements, etc.;

- development of forms of accounting documents for registration of various financial and economic transactions, in the absence of their officially approved, mandatory samples;

- working with the tax base, calculating taxes and transferring them to budgets of various levels;

- calculation and transfer of insurance contributions to extra-budgetary funds (PFR, Social Insurance Fund, Compulsory Medical Insurance Fund);

- calculation of salaries and other payments to employees of the organization, incl. social in nature (financial assistance, bonuses, sick leave, vacation pay, business trips, etc.);

- preparation of accounting and tax reporting;

- regularly informing the immediate supervisor about current processes in accounting, as well as timely reports of all non-standard, complex, controversial situations;

- participation in activities to inventory the property and financial condition of the enterprise;

- participation in audits, tax and other inspections initiated by both the management of the enterprise and supervisory authorities;

- timely familiarization with amendments made by law to the rules of accounting and tax accounting and reporting at enterprises, as well as their application in practice;

III. Rights

3.1. The organization's accountant has the following powers and rights:

- make to management reasoned and substantiated written proposals for improving and optimizing the work of both yourself and the enterprise as a whole;

- participate in meetings, planning meetings, meetings, discussions and other events directly related to his activities;

- improve your professional level, including attending courses, seminars, webinars, conferences, trainings, etc.;

- request documents (including archival ones), teaching aids and other materials needed to solve current issues and problems;

- make constructive proposals to eliminate violations, errors, and shortcomings identified during the work;

- sign documents within his competence;

- refuse to perform work functions if there is a threat to life or health.

IV. Responsibility

Disciplinary liability threatens the accountant for the following actions:

4.1. Neglect of fulfilling job duties, including complete evasion of them.

4.2. Malicious, regular violation of the internal rules established at the enterprise, work and rest regime, discipline, as well as violation of any types of safety and other regulatory regulations.

4.3. Failure to comply with orders and instructions issued by the organization’s management or immediate supervisor.

4.4. Causing (intentional or unintentional) material damage to the company.

4.5. Disclosure of confidential information about the organization.

4.6. All the above points strictly comply with the current legislation of the Russian Federation.

V. Working conditions

5.1. An accountant must obey the company’s internal rules, which detail the conditions of his work.

5.2. If necessary, the accountant may be sent on business trips.

AGREED

Deputy Director for Economic Affairs

LLC "Supplies Wholesale"

Sterkhov/Sterkhov R.A./

"12" August 2014

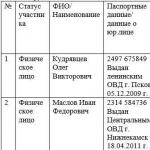

I have read the instructions:

Simonov Andrey Alexandrovich

Accountant at Supply Wholesale LLC

Passport 2435 No. 453627

Issued by the Department of Internal Affairs of the Leninsky district of Perm

09/14/2012 department code 123-425

Signature Simonov

"17" August 2014

FILES

Why do you need a job description?

This document is of great importance both for the management of the enterprise and for the accountants themselves. It allows the first to competently coordinate and manage the work of subordinates, and the second to clearly understand work functionality and responsibility. In addition, in the event of controversial situations that require resolution in court, the job description can serve as evidence of the presence or absence of guilt on the part of the employee or employer. The more carefully and accurately the requirements for the employee are spelled out, as well as his rights, responsibilities and other points of the job description, the better.

Basic rules for an accountant's job description

There is no unified form for this document, so enterprises can develop an accountant’s job description on their own. Due to the lack of an approved template, at different enterprises employees employed in the same positions may perform slightly different duties, although the main functions are still standard and similar.

The document is divided into four main parts:

- "General provisions"

- "Job Responsibilities"

- "Rights",

- "Responsibility",

but, if desired, the management of the enterprise can add other sections.

The job description is drawn up in one copy, and if there are several accountants in the organization, then its copies are printed in an amount equal to the number of accountants. Each accountant whose functions correspond to the job responsibilities specified in the document must sign it. In the same way, each document must be certified by an employee who is responsible for compliance with the rules and functionality prescribed in the job description and the head of the organization.

Drawing up a job description for an accountant

The upper right part of the document is reserved for approval by the head of the enterprise. Here you should enter his position, name of the organization, last name, first name, patronymic, and also leave a line for signature with mandatory decoding. Then the title of the document is written in the center of the line.

Main part of the instructions

In the first section called "General provisions" you need to enter which category of employees the storekeeper belongs to (specialist, worker, technical staff, etc.), then indicate on the basis of what order the accountant is appointed, to whom he reports and who replaces him, if necessary (there is no need to write specific names here , it is enough to indicate the positions of authorized employees).

The next step is to enter into the document the qualification requirements that the accountant must meet (specialization, education, additional professional training), as well as length of service and work experience, with which the employee can be allowed to perform work functions.

Further in the same section you need to list all the regulations, rules, orders with which the accountant must be familiar: standards and forms of documents accepted in the organization, rules for maintaining accounts and correspondence, organization of accounting document flow, rules on safety, labor protection and internal schedule, etc.

Second section

Second section "Job responsibilities of an accountant" directly concerns the functions that are assigned to the accountant. They may be different at different enterprises, but they should always be described in as much detail as possible. If there are several accountants in an enterprise and they have different functions, you must carefully ensure that there is no duplication in job responsibilities.

Third section

Chapter "Rights" includes the powers vested in an accountant to perform his or her job effectively. Here you can separately indicate his right to interact with the organization’s management and other employees, as well as representatives of other structures if such a need arises. Rights must be spelled out in the same way as responsibilities - accurately and clearly.

Fourth section

In chapter "Responsibility" specific violations of the accountant are established, for which internal sanctions and penalties are provided. In one of the paragraphs, it is necessary to indicate that the applied measures comply with the framework of the law and the Labor Code of the Russian Federation.

Fifth section

The last section of the job description includes: "Working conditions"- in particular, how they are determined (for example, internal labor regulations), as well as any features, if any.

Finally, the document must be agreed upon with the employee who is responsible for compliance with the rules and regulations prescribed in the accountant’s job description (this may be the immediate supervisor, the head of the human resources department, etc.). Here you need to enter his position, name of the organization, last name, first name, patronymic, as well as put a signature and be sure to decipher it.

Please indicate below accountant details:

- his last name, first name, patronymic (in full),

- Name of the organization,

- passport details,

- signature,

- date of familiarization with the document.

There is no need to put a stamp on the job description.

Accountant job description

1. General Provisions

1. This job description defines the job duties, rights and responsibilities of an accountant.

2. A person who has a secondary vocational (economic) education without requirements for work experience or special training according to an established program and work experience in accounting and control of at least 3 years is appointed to the position of accountant. A person who has a higher professional (economic) education without requirements for work experience or a secondary vocational (economic) education and work experience as an accountant for at least 3 years is appointed to the position of category II accountant. A person with a higher professional (economic) education and work experience as an accountant of category II for at least 3 years is appointed to the position of category I accountant.

3. An accountant must know legislative acts, regulations, instructions, orders, guidelines, methodological and regulatory materials on organizing accounting of property, liabilities and business transactions and reporting; forms and methods of accounting at the enterprise; plan and correspondence of accounts; organization of document flow in accounting areas; the procedure for documenting and reflecting on accounting accounts transactions related to the movement of fixed assets, inventory and cash; methods of economic analysis of economic and financial activities of an enterprise; rules for operating computer equipment; economics, labor organization and management; market methods of management; labor legislation; rules and regulations of labor protection.

4. An accountant is appointed and dismissed by order of the head of the institution (enterprise, organization) in accordance with the current legislation of the Russian Federation.

5. The accountant reports directly to the chief accountant.

2. Job responsibilities

Performs work on maintaining accounting records of property, liabilities and business operations (accounting for fixed assets, inventory, production costs, sales of products, results of economic and financial activities, settlements with suppliers and customers, as well as for services provided, etc. .). Participates in the development and implementation of activities aimed at maintaining financial discipline and rational use of resources. Receives and controls primary documentation for the relevant areas of accounting and prepares them for accounting processing. Reflects on the accounting accounts transactions related to the movement of fixed assets, inventory and cash. Prepares reporting estimates of the cost of products (works, services), identifies sources of losses and unproductive costs, and prepares proposals for their prevention. Accrues and transfers taxes and fees to the federal, regional and local budgets, insurance contributions to state extra-budgetary social funds, payments to banking institutions, funds to finance capital investments, wages of workers and employees, other payments and payments, as well as deductions for material incentives for enterprise employees. Provides managers, creditors, investors, auditors and other users of financial statements with comparable and reliable accounting information in the relevant areas (areas) of accounting. Develops a working chart of accounts, forms of primary documents used for registration of business transactions for which standard forms are not provided, as well as forms of documents for internal accounting reporting, participates in determining the content of basic techniques and methods of accounting and technology for processing accounting information. Participates in conducting an economic analysis of the economic and financial activities of an enterprise based on accounting and reporting data in order to identify on-farm reserves, implement savings regimes and measures to improve document flow, in the development and implementation of progressive forms and methods of accounting based on the use of modern computer technology, in Conducting inventories of cash and material assets. Prepares data on the relevant areas of accounting for reporting, monitors the safety of accounting documents, draws them up in accordance with the established procedure for transfer to the archive. Performs work on the formation, maintenance and storage of a database of accounting information, makes changes to reference and regulatory information used in data processing. Participates in the formulation of the economic formulation of problems or their individual stages, solved with the help of computer technology, determines the possibility of using ready-made projects, algorithms, application software packages that allow the creation of economically sound systems for processing economic information.

3. Rights

The accountant has the right:

1. make proposals to management on issues of organization and working conditions;

2. use information materials and regulatory documents necessary to perform their official duties;

3. undergo certification in the prescribed manner with the right to receive the appropriate qualification category;

4. improve your skills.

The accountant enjoys all labor rights in accordance with the Labor Code of the Russian Federation.

Limited Liability Company "Alfa"

Job Description No. 1

general director

Moscow 14.03.2016

1. GENERAL PROVISIONS

1.1. This job description defines the duties, rights and responsibilities

General Director

1.2. The decision on appointment and dismissal is made decision

general meeting of shareholders

.

1.3. A person who has higher education and

At least five years of experience in management positions

.

1.4. The General Director in his activities is guided by:

– legislative and regulatory acts regulating production

society

;

– charter society

, local regulations society

;

– this job description.

1.5. The CEO must know:

– legislative and regulatory acts regulating production

economic and financial-economic activities society

, regulations

federal, regional and local government bodies and administrations,

defining priority directions for economic development;

– methodological and regulatory materials of other bodies related to the activities of society

;

– profile, specialization and structure features society

;

– prospects for technical, economic and social development society

and spheres

activities;

– production capacity and human resources society

;

– technology for the production of products (services) of the company

;

– the procedure for drawing up and agreeing on business plans for production, economic and

financial and economic activities society

;

– market methods of management and management society

;

– a system of economic indicators that allows society

determine your position on

market and develop programs to enter new markets;

– the procedure for concluding and executing business and financial contracts;

– scientific and technical achievements and best practices in the relevant field of activity

society

;

– labor legislation;

– economic and financial management society

, organization of production and labor;

– the procedure for developing and concluding collective agreements and regulating social

labor relations;

– rules and regulations of labor protection, safety and fire protection.

1.6. The CEO is accountable general meeting of shareholders .

1.7. During the absence of the General Director (vacation, illness, etc.) his duties

performed by a deputy (if there is none, a person appointed in accordance with the established procedure),

who acquires the corresponding rights and is responsible for the execution

duties assigned to him.

2. JOB RESPONSIBILITIES

2.1. Provides ongoing management of all activities society

in accordance with

current legislation.

2.2. Organizes the work and effective interaction of all structural divisions and

directs their activities to the development and improvement of production, taking into account social

and market priorities, increasing operational efficiency society

, volume growth sales

(services)

and increase profits, quality and competitiveness we produce oh products

(services)

, its compliance with standards in order to conquer the market and meet the needs

population in relevant types products (services)

.

2.3. Ensures execution society

all obligations to the federal, regional

and local

budgets, state extra-budgetary social funds,

suppliers, customers and creditors, including banking institutions, as well as economic and

employment contracts and business plans.

2.4. Organizes production and economic activities based on widespread use

the latest equipment and technology, progressive forms of management and labor organization, scientifically

reasonable standards for material, financial and labor costs, market research

market and best practices in order to fully improve the technical level and quality

products (services)

, economic efficiency of its production, rational use

production reserves and economical use of all types of resources.

2.5. Takes measures to ensure society

qualified personnel, rational

use and development of their professional knowledge and experience, creating safe and

favorable working conditions for life and health, compliance with the requirements of legislation on

environmental protection.

2.6. Provides the right combination of economic and administrative methods

leadership, unity of command and collegiality in discussing and resolving issues, material and

moral incentives to increase production efficiency, application of the principle

material interest and responsibility of each employee for the work entrusted to him

and the results of the work of the entire team, payment of wages on time.

2.7. Together with the workforce (and trade union organization)

provides based on

principles of social partnership development, conclusion and implementation of collective

contracts, compliance with labor discipline, promotes the development of work motivation,

employee initiatives and activities society

.

2.8. Resolves issues related to financial, economic and production

economic activity society

, within the limits of the rights granted to him by law,

entrusts the management of certain areas of activity to other officials -

Deputy Director, heads of structural divisions.

2.9. Ensures compliance with legality in activities society

and its implementation

economic relations, the use of legal means for financial

management and functioning in market conditions, strengthening contractual and financial

discipline, regulation of social and labor relations, ensuring investment

attractiveness society

in order to maintain and expand the scale

entrepreneurial activity.

2.10. Protects property interests society

in court, arbitration, government agencies

power and management.

2.11. Maintains official confidentiality regarding the information received, ensures

compliance with measures and creation of conditions that prevent leaks of confidential information,

notifies immediately Board of Directors

about all cases of blackmail, threats and attempts to

application, regardless of the nature of the requirements, as well as attempts to obtain by whom

- information related to activities society

.

The General Director has the right:

3.1. Act on behalf of without a power of attorney society .

3.2. Represent the interests society

in relations with citizens, legal

persons, government and management bodies.

3.3. Manage property and funds society

in compliance with the requirements,

determined by law, charter society

, other regulatory legal acts.

3.4. Open current and other accounts in banking institutions.

3.5. Conclude employment contracts.

3.6. Make decisions about hiring employees society

, about their transfer and dismissal, about measures

rewards and disciplinary sanctions.

3.7. Issue powers of attorney to perform civil transactions, representation .

3.8. Within the limits established by law, determine the composition and volume of information,

constituting a trade secret, the procedure for its protection.

3.9. Demand from lower-level managers, specialists and other employees society

performing official duties.

3.10. Bring to the attention of lower-level managers information about all identified

shortcomings in the process of activity and make proposals to eliminate them, as well as make

suggestions for improvement society

.

3.11. Request from lower-level managers and specialists society

information and

documents necessary to perform your official duties.

3.12. Involve subordinate managers in solving the tasks assigned to him and

specialists, give instructions.

4. RESPONSIBILITY

The General Director is responsible:

4.1. For improper performance or failure to fulfill one’s official duties,

provided for by this job description, within the limits determined by the current

labor legislation of the Russian Federation.

4.2. For violations committed in the course of carrying out its activities, within the limits

determined by current administrative, criminal and civil legislation

Russian Federation.

4.3. For causing material damage within the limits determined by the current labor and

civil legislation of the Russian Federation.

4.4. For the consequences of decisions made by him that go beyond his powers,

established by current legislation, charter society

, other normative

legal acts. CEO society

is not exempt from liability if

actions entailing liability were taken by persons to whom he delegated his

rights.

4.5. For dishonest use of property and funds society

in one's own interests

or in interests contrary to the interests of the founders, within the limits determined

civil, criminal, administrative legislation.

5. PROCEDURE FOR REVISING THE JOB DESCRIPTION

5.1. The job description is reviewed, amended and supplemented as

necessity, but at least once every five years

.

5.2. Everyone is familiarized with the order to make changes (additions) to the job description

employees who are subject to this instruction and sign.

The job description was developed in accordance with the order CEO from 15

February 2016 No. 67

.

AGREED

Head of HR Department

E.E. Gromova

14.03.2016

I have read these instructions.

I received one copy in my hands and undertake to keep it at my workplace.

Don’t want to have problems with the servicing bank and your staff? Then immediately take a look at the payroll accountant job description. Ideally, it is better to bring it as close as possible to the professional standard that is developed for this profession. And sometimes it is a duty. Our consultation will help you cope with the problem. You can find out the specifics of the payroll accountant job description.

Key document

For a payroll accountant, a job description is perhaps his main document after the employment contract. The manager must approve it by his order.

The presence of such instructions means that the payroll accountant understands his area. And in case of problems with salary payments and (or) income tax, insurance contributions, a link to a specific sample job description for a salary accountant will make it possible to put such a specialist in his place. In case of a stalemate, say goodbye to him. This approach is also applicable to the job description of a payroll accountant of a budgetary institution.

It should be noted that the job description of a payroll accountant stands somewhat apart from similar instructions of immediate superiors - the chief accountant and his deputy. The reason is simple: the payroll accountant's responsibilities are narrower. Also see "" and "".

It is noteworthy that domestic legislation does not directly impose special requirements on d job description of an accountant for salaries (personnel) of the 20178 model. True, when approving the text of this document, it is easier not to exercise freedom of creativity, but to focus on the appropriate professional standard. More about him.

What is he responsible for?

The responsibilities of a payroll accountant should not extend beyond this job function. Let's name the main ones:

- calculate wages;

- monitor the state of the wage fund;

- all issues of income tax on payments that an organization makes in favor of individuals;/li>

- all income tax issues on payments made by the organization in favor of individuals;

- calculation and payment of insurance premiums;

- reflection in accounting of transactions with salaries and other payments to personnel, as well as taxes and contributions from them;

- reflection of relevant payments in tax accounting, preparation of tax reporting (mainly for personal income tax);

- processing time sheets;

- analysis of the correctness of registration of temporary disability certificates and other documents on the right to be absent from the workplace;

- control of payments to employees according to statements;

- preparation of materials for inspections by the Federal Tax Service, etc.

The fact is that the qualifications (we’re just talking about them!) of an accountant as a whole may be subject to the following requirements:

- Labor Code of the Russian Federation;

- other federal laws;

- other regulatory documents of the Russian Federation.

Only in this case, it is necessary to mirror the requirements of the professional standard into the job description of a salary accountant of the 2018 model. Then it will be fully relevant to the law. We are talking about these positions of the Accounting Law:

Yes, this law only applies to accountants of some public (open) joint-stock companies. Meanwhile, practice shows that the specified requirements for the qualifications of an accountant for payroll accounting in job descriptions are already universally applied by both ordinary LLCs and budgetary organizations.